The new Form 1023 online version on Pay.gov

On January 31st of 2020, the IRS abandoned the paper format of the form 1023. Those who used the paper version were given 90 days grace period and that ended on 30th of April 2020. Going forward, every application has to be filed online through Pay.gov portal. The content of the form has not changed much, the major changes are the numbering of the questions. I have updated all the pages of this site and the instructions are correct and match the latest pay.gov form 1023 online version. Just in case you find a broken link or something wrong please let me know.

You can download a printable copy of the form 1023 here but please only use it as a reference and fill the actual form online on pay.gov.

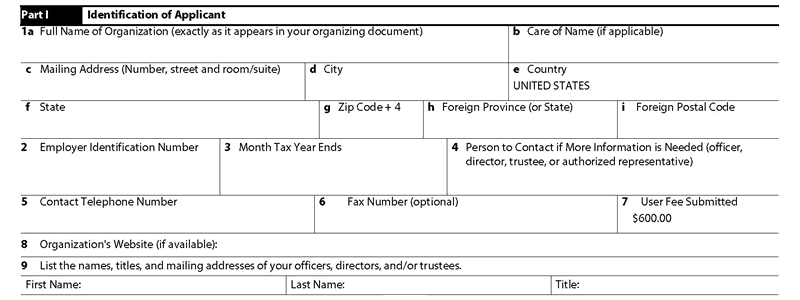

In the Form 1023 Part I, You are asked the basic and preliminary questions to establish who you are, and your legality as an entity. Your nonprofit organization starts its journey to tax exemption from here.

Form 1023 Part I, Full name of organization (exactly as it appears in your organizing document)

Kind of a no-brainer but apparently not. You have to use the full name of your organization. If your organization is called “Bread For Dummies Corp.” don’t write “Bread For Dummies Corporation.” Use the correct name all the time in every reference.

Form 1023 Part I, c/o Name (if applicable)

In this section list the name of your representative officer so all communications are done through one person. This way you don’t have to chase down your board members to find out who got mail.

Form 1023 Part I, Mailing address (Number and street)

A post office box is the best option as it will be less likely for your dog to chew your determination letter. Also PO BOX is a good idea because you can direct all your mails to a single address. Unless you already have an office and you do get your mails there, consider using a mail box to be safe.

Form 1023 Part I, Employer Identification Number (EIN)

You should already have your EIN, see What is an EIN and how to get one for your 501c3 nonprofit if you don’t.

Form 1023 Part I, Month the annual accounting period ends

It’s entirely up to your board to set your fiscal year. It can be January, March, or any other month. It’s a good idea to set your fiscal year to December 31st so every accounting period ends with the actual year.

Some organizations such as schools set their fiscal tax year to June because that’s when schools generally close for the year. But if you’re not a school you should always use December and save yourself an accounting headache.

Form 1023 Part I, Person to Contact if More Information is Needed (officer, director, trustee, or authorized representative)

Use the officer r director you listed in the section b on this page. Keep that person the same throughout the application including the signature line.

Form 1023 Part I, Organization’s website:

If you are starting your nonprofit organization out of your home or actually care about succeeding with your mission, you need a website. There’s no way around it. Not later, not tomorrow, but now. You need to have it up and running before you submit your application. Your organization’s website is your image for the IRS, where they can find more information and see if you actually mean business. Your website is your real office.

You can run an organization out of a garage with a well built website, but you can’t reach out to potential audience and donors without it. Think of it this way; how many of you have ever been to Google headquarter, and how many of you have been to Google website? It also serves as your medium for transparency, and publicly sharing your organizational documents which are required by law. Please see Tax Exempt Organizations Public Disclosure Requirements to see what documents you have to make available for public inspection.

Not only that, the IRS explicitly instructs its examiners of your application to review the exempt organization’s website for existence of required disclosure for tax deductibility on your donation page.

If you don’t have a website yet, you can get 75% off nonprofit website design through DreamDare Production.

Form 1023 Part I, List the names, titles, and mailing addresses of your officers, directors, and/or trustees.

Here you should list the name of all your directors and their corresponding contact information. If you need to add more directors, I suggest to use my attachment rather than using the box provided.

There is no minimum number for directors in a nonprofit organization set by the Federal Government, but the IRS wants to see that the organization is managed by a qualified and diverse board of directors. A good nonprofit board of directors should at least have four or five directors and preferably from both sexes. If you have two directors that are on the board who are related to each other, you need to count them as only one (1), and up the umber of directors to 6 or 7.

The more caring your board is, the better the outcome of your nonprofit organization will be. Distribution of power is what the IRS has in mind, and a two or three member board of directors does not guarantee that. Directors of a nonprofit organization CAN NOT be compensated for their board duties.

(Next Step) Instructions For Form 1023 Part II – Organizational Structure

(Previous Step) What Is An EIN And How To Get One For Your Nonprofit

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.