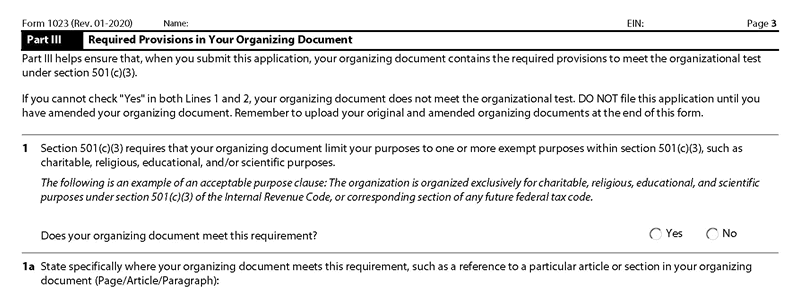

Form 1023 Part III (3) – required provisions, purpose clause, and dissolution Clause

Form 1023 Part III (3) asks for required provisions which is specific language that needs to be included in the Nonprofit Articles of Incorporation of the organization. Here, IRS is asking your nonprofit organization to state its legal promise to the public. the number 1 reason for questioning or rejection from the IRS is not having the following required clauses in your organizing documents. Here’s the question:

Form 1023 Part III: Section 501(c)(3) requires that your organizing document state your exempt purpose(s), such as charitable, religious, educational, and/or scientific purposes. Check the box to confirm that your organizing document meets this requirement. Describe specifically where your organizing document meets this requirement, such as a reference to a particular article or section in your organizing document.

This is where you should have uttered the following words without modifications in your articles of incorporation. If your original articles of incorporation is lacking these two clauses, you have to amend or restate your articles of incorporation. Don’t change it, add to it or alter it. This is the language that IRS understand so write it like a parrot in your articles of incorporation. Besides just copying and pasting these sentences, you need to believe in them. This is the meat and bone of a charity, so take it to heart:

Purpose Clause

(Name of the Nonprofit Organization) is organized exclusively (Pick whatever applies: for religious, charitable, scientific, literary or educational) purposes including, for such purposes, the making of distributions to organizations that qualify as exempt organizations under section 501(c)(3) of the Internal Revenue Code, or corresponding section of any future federal tax code. No part of the net earnings of YOUR ENTITY’S NAME shall inure to the benefit of, or be distributable to its members, trustees, officers, or other private persons, except that the corporation shall be authorized and empowered to pay reasonable compensation for services rendered and to make payments and distributions in furtherance of the purposes set forth in the purpose clause hereof.

No substantial part of the activities of the corporation shall be the carrying on of propaganda, or otherwise attempting to influence legislation, and the corporation shall not participate in, or intervene in (including the publishing or distribution of statements) any political campaign on behalf of any candidate for public office.

Notwithstanding any other provision of this document, the corporation shall not carry on any other activities not permitted to be carried on (a) by any organization exempt from federal income tax under section 501 (c) (3) of the Internal Revenue Code, corresponding section of any future federal tax code, or (b) by an organization, contributions to which are deductible under section 170 (c) (2) of the Internal Revenue Code, or corresponding section of any future federal tax code.

(Name of the Nonprofit Organization) is not organized and shall not be operated for the private gain of any person. The property of the corporation is irrevocably dedicated to its (pick one: educational, religious, charitable) purposes. No part of the receipts, or net earnings of the corporation shall inure to the benefit of, or be distributed to any individual. The corporation may, however, pay reasonable compensation for services rendered, and make other payments and distributions consistent with these Articles.”

Dissolution Clause

Upon termination or dissolution of the (Name of the Nonprofit Organization), any assets lawfully available for distribution shall be distributed to one (1) or more qualifying organizations described in Section 501(c)(3) of the Internal Revenue Code of 1986 (or described in any corresponding provision of any successor statute) which organization or organizations have a charitable purpose which, at least generally, includes a purpose similar to the terminating or dissolving corporation.

The organization to receive the assets of the (Name of the Nonprofit Organization) hereunder shall be selected by the discretion of a majority of the managing body of the (Name of the corporation)and if its members cannot so agree, then the recipient organization shall be selected pursuant to a verified petition in equity filed in a court of proper jurisdiction against the (Name of the corporation) by one (1) or more of its managing body which verified petition shall contain such statements as reasonably indicate the applicability of this section. The court upon a finding that this section is applicable shall select the qualifying organization or organizations to receive the assets to be distributed, giving preference if practicable to organizations located within the State of Montana.

In the event that the court shall find that this section is applicable but that there is no qualifying organization known to it which has a charitable purpose, which, at least generally, includes a purpose similar to this corporation, then the court shall direct the distribution of its assets lawfully available for distribution to the Treasurer of (Your State) to be added to the general fund.

As long as you have the above clauses, you don’t need to rely on State Law for dissolution.

Please note that if you’re applying for tax exemption as a Private Foundation, your required provisions of purpose and dissolution for the articles of incorporation are the same, but you have to add additional provisions other than the statements above. See the private foundations requirements if you do fall under this category.

(Next Step) IRS Form 1023 Part IV – Narrative Description & Your Activities

(Previous Step) Instructions For Form 1023 Part II – Organizational Structure

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.