What is Narrative of Activities on the Form 1023?

Form 1023 Part IV (4), Narrative Description of Activities of the IRS form 1023 is the most important section of your nonprofit 501c3 application. Narrative Description of Activities on the form 1023 is basically the complete story of your organization, from its inception to projection of what it will do in the future. Like every good story, you have to start from the beginning and don’t leave it open ended.

If you fail to write a great narrative description of activities, you can certainly kiss your form 1023 application fee goodbye, and your nonprofit organization dreams shattered. DO NOT copy and paste from other narratives. You have to be original and bold.

Narrative of Activities is the first section of the part IV (4), longest section of the form 1023 application, and the trickiest one as well. IRS is very specific about the narrative of your activities, and when the IRS ask you to be specific, just buckle up. What I will explain in this page will relate to almost 95% of public charities out there, I will however leave out hospitals, governmental entities, child care services, economic developers, and other odd entities. I have provided examples of answers which should clarify the nature of the question.

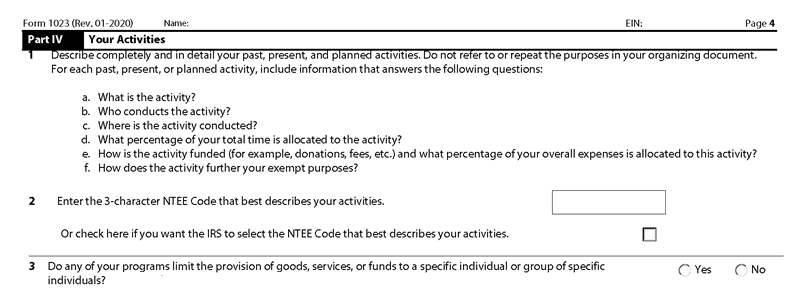

In Form 1023 Part IV (4), IRS asks you to describe your past, present, & planned activities in a narrative.

Rule number one of writing a great narrative of activities for the form 1023 is not to repeat yourself. If you have something to say in your narrative, say it only once in your entire application, and if you have to say it again, just refer to that section.

Rule number two of writing an effective narrative description for the form 1023 is to be concise, up to the point, and stay away from being cute, and worst still, including your meaningless (in the eyes of the law) convictions.

For example:

- If your nonprofit organization is a ministry (applying for 501c3 as a religious organization), it’s OK to say that Jesus Christ compelled you to help the poor and feed the hungry.

- However, if you’re organization’s mission is to clean up the oceans, (applying for 501c3 as an environmental organization), there’s absolutely no reason to let the examiner know that your a Christian and how much you love Jesus Christ, it’s meaningless, unnecessarily adds to the length of your narrative, and it simply doesn’t help you.

Rule number three of writing your form 1023 narrative is that you can’t be too vague. Your form 1023 narrative has to be minimum of 3-4 pages long, don’t use the provided box on the form 1023 part IV to write your activities as it only gives you 1000 characters to play with. You cannot possibly explain in detail your past, present and future activities in that small box. If you use that box, I promise you that you’ll get a letter from the IRS examiner asking you for further information. On Part IV you should just say please see attachment and write your narrative as an attachment.

How to write a great Narrative Description of Activities for the Form 1023

To write a compelling Narrative Description of Activities, you need to answer the following questions with the smallest detail:

- What is the nonprofit activity?

- Who conducts the activity?

- When is the activity conducted?

- Where is the activity conducted?

- How does the activity further the nonprofit organization’s exempt purposes?

- What percentage of the nonprofit organization’s total time is allocated to the activity?

- How is the activity funded?

As an IRS examiner, I would look at the narrative section of your form 1023 and would want to know anything and everything about this organization. So be specific. If you are running a Save the Snails Foundation, say how many snails you are hoping to save, the method of saving, where you put them after you save them, and why even bother saving the damned snails in the first place. Then you need to say what happens after the snail is saved. Every story needs a happy ending.

Don’t forget the percentage of time and resources allocated for each exempt activity (your proposed programs), the IRS will not process your 501c3 application if you don’t have the percentage in your narrative.

You can support your narrative of activities by newspaper articles, TV interviews, website interviews, link to your organization’s website, brochures, business cards, and any kind of positive publicity you had received. So before writing your Narrative Description of Activities, get in newspapers, have interviews, get yourself out there, it helps.

Using Revenue Rulings in your narrative

Your narrative description is where you make your case. You don’t rely on the goodwill of the tax people; you tell them just like in the courtroom why they should grant you the exemption based on their own previous rulings. These rulings are legal precedents.

- For example, John Doe sued the IRS on a ground that his nonprofit organization was denied exemption because of “X” reason, and the court ruled on his behalf favorably. This ruling becomes a precedent which you can use to present your own case. Read this section 100 times if you have to, because it is very important.

When you are done writing your narrative description of activity, you make your case by referring to the Internal Revenue Code and these rulings. See the narrative description examples bellow and note the references to the Internal Revenue Code. Here I make my case by telling the IRS examiner that I know and understand the law. To find a ruling that matches your case, you can access the complete archive on IRS website by searching “Revenue Rulings Archive”.

Where can I find samples of Narrative Description of Activities?

Here you can download a zip file containing several nonprofit narrative description of activities from successful 501c3 applications for tax exemption in PDF format. Don’t copy and paste the content into your attachment, you need to write a unique and meaningful narrative, However you can see how it’s been done and you can copy the structure. Either way, they are available with the rest of my templates as Microsoft word documents as well.

Here you can download a zip file containing several nonprofit narrative description of activities from successful 501c3 applications for tax exemption in PDF format. Don’t copy and paste the content into your attachment, you need to write a unique and meaningful narrative, However you can see how it’s been done and you can copy the structure. Either way, they are available with the rest of my templates as Microsoft word documents as well.

What is NTEE Code and where you can find it

The new and improved online version of form 1023 has a question that wasn’t included in the older revisions and it asks for a corresponding NTEE code for your organization.

The National Taxonomy of Exempt Entities (NTEE) system is used by the IRS and NCCS to classify nonprofit organizations. It is also used by the Foundation Center to classify both grants and grant recipients (typically nonprofits or governments). NCCS and the IRS use the NTEE-CC system, described below, while the Foundation Center uses a slightly different version with more codes, as well as “population/beneficiary” codes to indicate the type of population served and “auspice” codes to indicate religious or governmental affiliation.

On question 2 of the Part IV of the form 1023, you can either enter the corresponding NTEE code or have IRS pick one for you. They usually get it wrong so I strongly suggest that you pick the closest code that describes your organization yourself if you can find one. Picking your own NTEE code also takes the burden off the examiner so be helpful if you can. You can see the list of NTEE codes here.

Providing Goods, Services, or Funds to Individuals & Organizations

The rest of the part IV of the Form 1023 is designed to reveal information regarding your activities with members, individuals, and organizations who might receive benefits from you along with your legislative activities. Most of the questions are self explanatory but I will highlight the traps and important ones here.

In a nutshell, you normally should not be organized solely to benefit another organization. At the same time, you cannot just benefit individuals and members either.

For example, you are running a breast cancer nonprofit organization. Your mission should be saving all the breast cancer patients you can. You cannot have an organization to raise funds and save only Sally who has cancer. Sally is an individual not a class. Your organization should work with a class of people, animals, issues… put it simply, you can not start an organization for an individual or two or three and expect to be exempt from paying taxes.

Do you or will you support or oppose candidates in political campaigns in any way?

Answer NO to support and opposition of candidates in political campaigns. You cannot do that. The term “political” used by the IRS means only opposing and supporting candidate for public offices; Senate, Congress, the White House, etc. It means participating or intervening in any political campaign on behalf of, or in opposition to candidates for public office.

This doesn’t mean that you cannot criticize the existing governor, President or the Joint Chiefs of Staff. I see many nonprofit organizations who go silent on matters that directly affects them and the public, and they do nothing for the fear of IRS penalizing them. That’s your freedom of speech, and it is your civil duty to your country to defend it when and where you see fit, so don’t be scared to exercise it.

Do you or will you attempt to influence legislation?

If “Yes,” explain how you attempt to influence legislation.

To answer this section, first you need to understand what legislation actually is.

For this purpose, legislation includes action by Congress, any state legislature, any local council or similar governing body, with respect to acts, bills, resolutions or similar items (such as legislative confirmation of appointive office), or by the public in referendum, ballot initiative, constitutional amendment or similar procedure. It does not include actions by executive, judicial or administrative bodies.

School boards, housing authorities, sewer and water districts, zoning boards and other similar federal, state or local special purpose bodies, whether elective or appointive, are considered administrative bodies.

Now influencing legislation means either directly or indirectly (Grass Roots) affecting the outcome of a legislation process. Direct lobbying refers to communications with members or employees of a legislative body, or with any other government official or employee who may participate in formulating the legislation, if the principal purpose of the communication is to influence legislation. Indirect or Grass roots lobbying refers to efforts to influence legislation through an attempt to affect the opinions of the general public or any segment of the general public.

Influencing legislation and lobbying are not illegal, but you have to keep it within permissible limits. In fact, a nonprofit organization is nothing without political power to further its agenda, so don’t shoot yourself in the foot by answering no. You can either choose to make the “election”, by filing the simple one-page Form 5768 with the IRS (if you are formed to support another charity, this option is not available to you), or you can opt for “substantiality” test.

If you opt for substantiality test, 1 to 5 percent of your total revenue should keep you on the safe side. You can answer like this:

We have not yet spent any volunteer time or any part of our budget to influence legislation. Our legislative activities will always be “insubstantial” and less than 2% of our volunteer time and expenses, if we decide to do so. Currently we have no plans or program in place to undertake such activities.

I have provided a wealth of information lobbying and political activities of nonprofit on this page, make sure you read this section.

Do you or will you make grants, loans, or other distributions to organizations?

This is really organization specific. You can answer YES if you do, or NO, if you don’t. Either way, be specific about your selection and approval methods if you do make grants, loans, or other distributions to other organizations. If you answered YES, you need to list real-life scenarios to clarify the situation. One thing that you need to be very careful about is that your organization should always be in control of the loaned, granted, or distributed funds. If you do one of the three, answer it like so and don’t be afraid to say see attachment and give a complete answer in your attachment:

We do not offer or provide grants or loans to other organizations. Distributions to other organizations will be documented with copies of receipts, letters or other relevant documents. According to our bylaws, any distribution would have to be approved by the board of directors. The method of approval would be documented. Distributions to organizations have not yet occurred since the incorporation.Please Note: Rev. Rul. 68-489, 1968-2 C.B. 210 (More rulings)

- An organization will not jeopardize its exemption under section 501(c)(3) of the Code, even though it distributes funds to nonexempt organizations, provided it retains control and discretion over use of the funds for section 501(c)(3) purposes.

- An organization exempt from Federal income tax under section 501(c)(3) of the Internal Revenue Code of 1954 distributed part of its funds to organizations not themselves exempt under that provision. The exempt organization ensured use of the funds for section 501(c)(3) purposes by limiting distributions to specific projects that are in furtherance of its own exempt purposes. It retains control and discretion as to the use of the funds and maintains records establishing that the funds were used for section 501(c)(3) purposes. Held, the distributions did not jeopardize the organization’s exemption under section 501(c)(3) of the Code.

Do you or will you make grants, loans, or other distributions to foreign organizations?

This is same as above, but needs more convincing that your funds don’t end up in North Korea or in hands of terrorists. Be very, very, very specific here. I cannot stress this enough. I’ve seen more questioning on this section from the IRS than any other section. This is an example:

We do not offer or provide grants or loans to any foreign or domestic organizations. If we decide that a contribution or distribution is necessary to fulfill our mission and our duty to further our exempt status, we will contribute at the discretion of the board of directors to foreign organizations.

An example would be contributing to a health institution that is providing treatment for chronic malnutrition. If we decide to contribute to such an institution, we will stipulate how the funds shall be used and will require the recipient to provide us with detailed records and financial proof of how the funds were utilized.

Although adherence and compliance with the US Department of the Treasury’s publication the “Voluntary Best Practice for US. Based Charities” is not mandatory, we the directors of XYZ Humanitarian Corp. willfully and voluntarily recognize and put to practice these guidelines and suggestions to reduce, develop, re-evaluate and strengthen a risk-based approach to guard against the threat of diversion of charitable funds or exploitation of charitable activity by terrorist organizations and their support networks.

We also comply and put to practice the federal guidelines, suggestion, laws and limitation set forth by pre-existing U.S. legal requirements related to combating terrorist financing, which include, but are not limited to, various sanctions programs administered by the Office of Foreign Assets Control (OFAC) in regard to our foreign activities.

Provide the name of each foreign organization, the country and regions within a country in which each foreign organization operates, and describe any relationship you have with each foreign organization.

Again, you should be specific in explaining your foreign activities. If you think you explained it enough, add two more sentences to it to be on the safe side. Example answer:

At this time XYZ Humanitarian Corp. has no relationship with any foreign organizations nor are there any current plans in progress to establish such relationships. Therefore, we cannot list any countries or regions at this time. That is not to say that it is not our intent to possibly establish a relationship with a foreign organization in the future but specific organizations and countries have not been identified at this time. Should there be any attempts to establish relationships in the future, XYZ Humanitarian Corp. will act with due diligence and in full accordance of any laws and requirements governing this corporation.

Does any foreign organization accept contributions earmarked for a specific country or specific organization?

Answer NO to earmarking and explain it like:

As mentioned above, we have no relationship with any foreign organizations, hence there are no organizations to list from line 14b. Furthermore, if we were to contribute to any foreign organizations in the future, we would not contribute to any organizations that specify, earmark or require that any part of our contributions be out of our control or in any way to be directed to any other organization other than the recipient(s) or organization(s) originally selected by XYZ Humanitarian Corp.

We will maintain full control of the contributed funds at all times with records and receipts, and if available, with supervision of our ambassadors in the field.

Do your contributors know that you have ultimate authority to use contributions made to you at your discretion for purposes consistent with your exempt purposes?

This is a great question and many thanks to the IRS for asking it. You should be very transparent on where, when, and how your funds are going to be spent, and the general public needs to know this information at the time of making the donation. Use your website, your donation forms, and any other medium you have at your disposal to make it very clear to the donor ahead of time. Example answer:

It is very clear to our contributors and especially the public how we operate, direct funds and the nature of programs. The donation page of our website lists where the donations go and for what purpose. For contributions other than credit cards, we have a donation form available which every contributor is required to fill and it specifically points out our mission, goals and functions. A copy of this form is included in with this attachment for your consideration.

Do you or will you make pre-grant inquiries about the recipient organization?

This a perfect example of answering this question:

We do not offer or provide grants to any individuals or organizations. But for any contributions made by XYZ Humanitarian Corp. to any organization, we take into consideration the tax-exempt status, overall financial standing of the recipient and we inquire about:

- The recipient’s name in English, in the language of origin, and any acronym or other names used to identify the recipient

- The jurisdictions in which the recipient maintains a physical presence;

- Any reasonably available historical information about the recipient that assures us of the recipient’s identity and integrity;

- The available postal, email and website addresses and phone number of each place of business of the recipient;

- A statement of the principal purpose of the recipient, including a detailed report of the recipient’s projects and goals;

- Copies of any public filings or releases made by the recipient, including the most recent official registry documents, annual reports, and annual filings with the pertinent government, as applicable; and

- The recipient’s sources of income, such as official grants, private endowments, and commercial activities.

Do you or will you use any additional procedures to ensure that your distributions to foreign organizations are used in furtherance of your exempt purposes?

Again, more explanation is order. Use the following example to put the IRS mind at ease and of course practice it as it’s a good way of ensuring that your are not going to get in trouble in future:

We generally will not contribute to any organization unless we have an ambassador in that country overseeing the distribution of the funds regardless of their location, domestic or foreign. The board of directors will conduct due diligence and maintain control of any funds contributed to any organizations and will comply with all applicable laws and guidelines. We will also, at our discretion, conduct the following to verify and ensure that funds are used appropriately and safely:

- conducting a reasonable search of publicly available information to determine whether the recipient is suspected of activity relating to terrorism, including terrorist financing or other support;

- assuring that recipients do not appear on OFAC’s master list of Specially Designated Nationals (the “SDN List”), maintained on OFAC’s website at www.treas.gov and are not otherwise subject to OFAC sanctions;

- with respect to key employees, members of the governing board, or other senior management at the recipient’s principal place of business, and for key employees at the recipient’s other business locations, we will, to the extent reasonable, obtain the full name in English, in the language of origin, and any acronym or other names used; nationality; citizenship; current country of residence; and place and date of birth;

- As a pre-condition to the issuance of a charitable contribution, we will require the recipient to certify that they are in compliance with all laws, statutes, and regulations restricting U.S. persons from dealing with any individuals, entities, or groups subject to OFAC sanctions.

Please note that since the events of 9/11, the department of treasury published a controversial article called “Anti-Terrorist Financing Guidelines”. It’s in your best interest to refer to this article if you want a smooth ruling.

Do you or will you operate in a foreign country or countries?

If “Yes,” name each foreign country and region within each country in which you do or will operate and describe your operations in each one.

This section is for those nonprofit organizations who will be operating in foreign countries. Since the 9/11, the IRS has gone crazy over distribution of funds outside the United States. If your organization is formed to support a foreign charity, you are 99% doomed. Please refer to Nonprofit 501c3 Friends of Organization Requirements for further clarification. Also for operating outside of the United States, you should show exactly what you mean by “operation” and when it comes to clarification of this section, the more is always more. This section should be carefully answered.

Example Answer:

It is the mission, duty and purpose of XYZ Humanitarian Corp. to address, educate, coordinate and provide aid and relief to eradicate chronic malnutrition and hunger regardless of its geographical position. Therefore XYZ Humanitarian Corp. may operate in any country and any region in any country around the world where we may fulfill our mission and further our exempt status. XYZ Humanitarian Corp. will obtain any required permits or permissions from the respective governments of any country we may operate in as required by law.

This includes complying with the sanctions, embargoes, and other restrictions imposed by the United Sates government to such countries. For detailed information regarding our foreign activities please refer to the section of our Narrative of Activities titled: Foreign activities. We may work closely[1] with other non-profit and non-governmental organizations who are active participants in the same field. This will allow us to further our exempt status by providing the services and aid in a timely and effective manner.

Note the IRS Revenue rulings; this is how you can make your case:

([1]Note: Working closely with other organizations does not constitute a “Close Connection” as it is defined on page 11, line 15 of the IRS publication of instruction for form 1023. It merely refers to exchange of information, non-financial data, suggestions and advices on locations and ways to address and direct the focus based on up-to-date information.)

Please Note: Rev. Rul. 71-460, 1971-2 C.B. 231

- “A domestic corporation that conducts a part or all of its charitable activities in a foreign country is not precluded from exemption under section 501(c)(3) of the Code. A domestic corporation that is otherwise exempt from Federal income tax under section 501(c)(3) of the Internal Revenue Code of 1954 carries on part of its charitable activities in foreign countries. Held, since its activities are charitable within the meaning of section 501(c)(3) of the Code when carried on within the United States, the conduct of such activities elsewhere does not preclude the organization from qualifying as an exempt organization under that section.

- The same conclusion applies if all of its charitable activities are carried on in foreign countries. With respect to deductibility of contributions to the organization under section 170 of the Code, see Revenue Ruling 63-252, C.B. 1963-2, 101 and Revenue Ruling 66-79, C.B. 1966-1, 48.”

Hospitals, Schools, Low Income Housing, and Scholarships

If your organization is a hospital, a school, provides low income housing or educational assistance and loans such as scholarships, you are required to complete additional schedules on the IRS Form 1023. Basically,

- If will be operating a school; complete Schedule B.

- Please note that Nonprofit Private Schools have to adopt a racial non-discrimination or nondiscriminatory policy or their application will be denied. See the mentioned link for complete instruction on this subject.

- If will be operating a hospital or medical care facility; complete Schedule C.

- If you will provide low-income housing; complete Schedule F.

- If you will provide scholarships, fellowships, educational loans, or other educational grants to individuals; complete Schedule H.

I have provided complete list of instruction for form 1023 schedules from A-H which you should use to answer these questions.

Check any of the following fundraising activities that you will undertake:

If you’re not a private foundation, of course you will be fundraising. List everything that comes to mind and be specific for each item. But before you go crazy on listing all the cute thoughts you have about fundraising, stop everything and read the Fundamentals of Fundraising for exempt organizations from top to bottom, and then bottom to top. This article explains the fundraising pitfalls and the IRS procedure and guideline used by Federal revenue agents to audit your organization when you make a fundraising mistake.

This article is invaluable because it pin points what they are looking for exactly in your application. It is also of utmost importance that exempt organizations read this article and familiarize themselves with the laws and limitation involved in fundraising activities, which non-compliance to these laws can result in revocation of the exempt status of the organization.

You should also read my proven nonprofit fundraising Ideas & grant writing tips article so you learn how to make money for your organization.

Do you or will you operate Bingo or non-bingo gaming activities?

Be specific when describing your gaming activities. A nonprofit organization is entitled to hold gambling events, but most likely the income will be an Unrelated Business Income (Bingo excluded) unless it matches some specific criteria. Don’t say no to gaming and gambling, it’s a great way of fundraising. However you need to be aware of the rules and laws regarding gambling for nonprofits. If you are not sure what to say, here is an example. If you are conducting raffles and such on your site, you need to make that clear now:

We will not operate Bingo but will utilize raffle games in our annual banquet fundraisers or at times on the corporation’s website.

An example of this activity would be offering 50/50 raffle games at our fundraising banquets and auctions. The participants will buy tickets of low value (e.g. $1) and with each ticket; they would have one chance of winning half of the pot at the end of the event. The other half of the pot will go towards the fundraising goal. Participants will generally donate their winnings back to the pot to be used toward the event’s goal.

Another example of games would be holding contests on our website to raise awareness for our mission. One type of contest would require the participants to write an essay regarding Malnutrition and Hunger to be considered and with that, would have the chance of winning a prize (e.g. $25 gift card to a sponsoring restaurant) at the end of the contest.

There will be no compensation of any sort for volunteers who carry on or help with these activities and all income and expenses will be documented as they occur.

Do you or will you engage in fundraising activities for other organizations?

If you fund-raise for other organizations be very specific and explain why you engage in such activity. As a nonprofit organization yourself, you should raise funds for your own programs and not for others. If you do not fund-raise for other organizations, answer NO. If not sure that you may or not, or in certain circumstances, clarify it as so:

No. We do not fund-raise for any specific organization and XYZ Humanitarian Corp. is not organized solely to contribute or fund-raise for any specific entity. However, at the discretion of the board of directors we may at times, choose to contribute to other 501 (c)(3) organizations which share a similar mission and only if the contributions further our exempt status. (Please see our Narrative of Activities for more information regarding how we contribute to other organizations.)

(Next Step) Instructions For Form 1023 Part V – Compensation & Arrangements

(Previous Step) Instructions For Form 1023 Part III – Required Provisions

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.