Form 1023 organizational structure, Corporation, LLC, or Unincorporated Association?

In Form 1023 Part II (2), the IRS tries to identify you as an eligible tax exempt organization. The name organization doesn’t mean anything in the eyes of the IRS. A group of cats in the alley meowing can be called an organization, but not necessarily a corporation. I know many of you think that calling your entity organization makes it cooler than a corporation, but in reality they all mean the same. Call it what it IS.

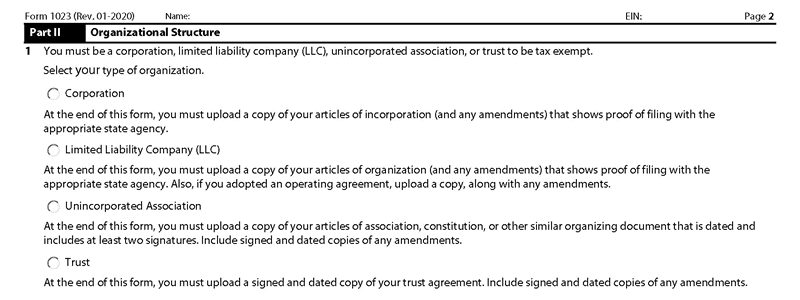

You MUST be a corporation, an unincorporated association, or a trust to be able to file the form 1023 and be tax exempt.

Almost all states have a special designation for nonprofit organizations and you should file your Nonprofit Articles of Incorporation to become a “Public Charity Organization”. Don’t incorporate as an LLC or any other form of entity as it makes it harder or impossible for no good reason.

Have you adopted bylaws?

If “Yes,” at the end of this form, upload a current copy showing the date of adoption.

On Form 1023 Part II (2) section 4 of the form 1023 you have to answer YES. You need to adopt bylaws to show how you run your nonprofit organization. IRS might accept a written explanation, but this explanation is your bylaws (well sort of).

If you don’t adopt a Nonprofit Bylaws, you can be almost sure that you will never receive a favorable answer on your application. So do it right the first time. If you download any bylaws from anywhere else just trash it and start again using the template on this site, you’ll thank me later. Go to Nonprofit Bylaws Page to learn how to write your bylaws.

Are you a successor to another organization?

At the start of these articles, I made it very clear that this website does not deal with those who have dipped their toes in the for-profit sector before going nonprofit. I will not provide advice to this class based on personal preference.

If you are a nonprofit (not a successor to a for-profit entity) which is unlikely, and not claiming exemption for prior periods, you can just apply normally. In this case, you qualify for tax exemption as an organization described in section 501(c)(4) for the period beginning with the date you were legally formed and ending with the date you are recognized under section 501(c)(3). Generally, contributions made to a section 501(c)(4) organization are not tax deductible.

If you’re a successor to another organization, you have to complete the Form 1023 schedule G. Please visit this page for more information.

(Next Step) Instructions For Form 1023 Part III – Required Provisions

(Previous Step) Instructions For Form 1023 Part I – Identification Of Applicant

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.