Church Charitable Contributions, Substantiation, & Disclosure Rules

A church or religious organization should be aware of the record keeping and substantiation rules imposed on donors of charities that receive certain quid pro quo contributions.

A church donor cannot claim a tax deduction for any contribution or donation of cash, a check or other monetary gift, unless the donor maintains a record of the contribution in the form of either a bank record (such as a cancelled check) or a written communication from the charity (such as a receipt or a letter) showing the name of the charity, the date of the contribution and the amount of the contribution.

A donor can’t claim a tax deduction for any single contribution or donation of $250 or more unless the donor obtains a contemporaneous, written acknowledgment of the contribution from the recipient church or religious organization. A church or religious organization that doesn’t acknowledge a contribution incurs no penalty; but without a written acknowledgment, the donor can’t claim a tax deduction.

Although it’s a donor’s responsibility to obtain a written acknowledgment, a church or religious organization can and should assist the donor by providing a timely, written statement containing:

- name of the church or religious organization,

- date of the contribution,

- amount of any cash contribution, and

- description (but not the value) of non-cash contributions.

In addition, the timely, written statement must contain one of the following:

- statement that no goods or services were provided by the church or religious organization in return for the donation,

- statement that goods or services that a church or religious organization provided in return for the contribution consisted entirely of intangible religious benefits, or

- description and good-faith estimate of the value of goods or services other than intangible religious benefits that the church or religious organization provided in return for the contribution.

The church or religious organization may either provide separate acknowledgments for each single contribution or donation of $250 or more or one acknowledgment to substantiate several single contributions of $250 or more. Separate contributions aren’t aggregated for purposes of measuring the $250 threshold.

Disclosure Rules that apply to Quid Pro Quo contributions to churches

A contribution or donation made by a donor in exchange for goods or services is known as a quid pro quo contribution. A donor may only take a contribution deduction to the extent that his or her contribution exceeds the fair market value of the goods and services the donor receives in return for the contribution. Therefore, donors need to know the value of the goods or services. A church or religious organization must provide a written statement to a donor who makes a payment exceeding $75 partly as a contribution and partly for goods and services provided by the organization.

Example of a Quid Pro Quo contribution to a church: If a donor gives a church a payment of $100 and, in return, receives a ticket to an event valued at $40, this is a contribution, and only $60 is deductible by the donor ($100 – $40 = $60). Even though the deductible amount does not exceed $75, since the contribution the church received is in excess of $75, the church must provide the donor with a written disclosure statement.

The statement must:

- inform the donor that the amount of the contribution that is deductible for federal income tax purposes is limited to the excess of money (and the fair market value of any property other than money) contributed by the donor over the value of goods or services provided by the church or religious organization; and,

- provide the donor with a good-faith estimate of the value of the goods or services.

The church or religious organization must provide the written disclosure statement with either the solicitation or the receipt of the contribution and in a manner that is likely to come to the attention of the donor. For example, a disclosure in small print within a larger document may not meet this requirement.

Exceptions to Disclosure Statement by churches

A church or religious organization isn’t required to provide a disclosure statement for quid pro quo contributions when:

- (a) the goods or services meet the standards for insubstantial value or

- (b) the only benefit received by the donor is an intangible religious benefit.

Additionally, if the goods or services the church or religious organization provides are intangible religious benefits (examples follow), the acknowledgment for contributions of $250 or more doesn’t need to describe those benefits.

Generally, intangible religious benefits are benefits provided by a church or religious organization that are not usually sold in commercial transactions outside a donation (gift) context.

Intangible religious benefits include:

- admission to a religious ceremony

- de minimis tangible benefits, such as wine used in religious ceremony

Benefits that are not intangible religious benefits include:

- tuition for education leading to a recognized degree

- travel services

- consumer goods

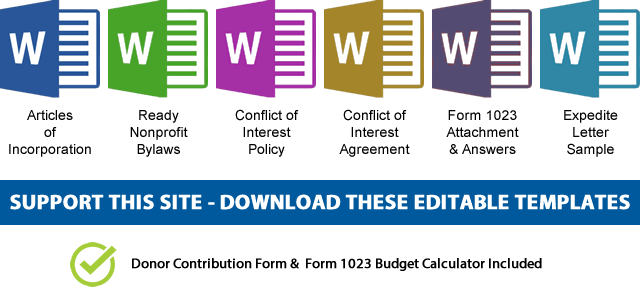

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.