How to compensate nonprofit organization board members, directors, officers or trustees

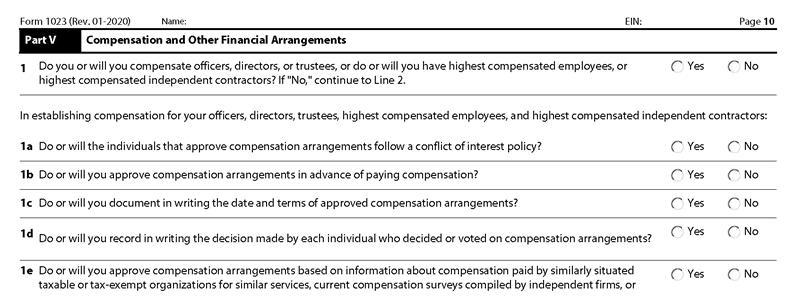

Form 1023 Part V (5) is where you explain the numbers and compensation of your directors, officers, and trustees. Form 1023 Part V (5) is a very important section and should not be taken lightly. These questions repeat over and over not because the IRS hopes you lie, but because they want to catch inconsistencies and fraud.

To the IRS’s credit, they’re hunting abusers of the tax exemption process – and there are plenty. So get familiar with the laws fast.

You are about to start a nonprofit organization and the nature of it comes with the name. Contrary to the nonprofit criminals who like to say that compensation equivalent to for-profit sector is “normal” or “justified”, I advise you to not listen to this garbage. You are about to start something meaningful, to help others, to do good – not to make yourself rich.

Those who take out large sums out of trusting donor contributions are nothing but thieves and abusers of the system, and if you are looking for your American Dream by milking the nonprofit sector, you should be hanged too. Don’t like my attitude towards this subject? Get the hell out and stop using this site.

Here’s an article I wrote on nonprofit executive compensation which you should read before deciding on how much to pay yourself. Knowing that, let’s get to work.

Do you or will you compensate officers, directors, or trustees, or do or will you have highest compensated employees, or highest compensated independent contractors?

I have written many detailed pages about compensation and payments made to nonprofit workers, which can be found under the Nonprofit IRS Compliance menu at the top of this website. Directors of a nonprofit organization CANNOT be compensated for their board duties.

One key distinction you need to understand before answering this question is the difference between employees and independent contractors. Considering that,the IRS is basically asking the same question twice on Form 1023, hoping you’ll list some of your board members.

In my experience, organizations that don’t compensate their officers and employees have a 90% better chance of getting approved without questioning than others. Compensation is not a bad thing – everyone should eat – but there’s a difference between eating and indulging..

Before you ask me, a highest compensated employee or an independent contractor is a person that would be making $100,000 or more.

Are any of your officers, directors, or trustees related to each other through family or business relationships?

This question is from the old Form 1023, but I’m leaving it here because it’s still important. They don’t ask it anymore, but they do check the names and addresses to see what’s really going on. Lots of nonprofits start as mom-and-pop setups — nothing inherently wrong with that – but relying on family members for your entire board? That’s a fundamental mistake. If your nonprofit board of directors consists mostly of your family, don’t be surprised when the IRS comes down hard on you. You’re about to run a (hopefully) charitable organization, not a family dynasty.

Elect board members who are qualified, unrelated individuals who actually care about your mission. If you absolutely must have your spouse or uncle on the board (which you shouldn’t), their voting power should be cut in half to keep power balanced. These rules aren’t mandatory – but they damn well should be.

Have you adopted a conflict of interest policy?

Your answer should be Yes. Then refer to the attached policy. And clarify it like “This was adopted by resolution of the board of directors on such and such date.” See the Sample Nonprofit Conflict of Interest Policy and prepare your own.

Do you or will you compensate any of your officers, directors, trustees, highest compensated employees, and highest compensated independent contractors through non-fixed payments, such as discretionary bonuses or revenue-based payments?

The answer to both of these questions should be NO. You CANNOT pay your employees based on commissions or revenue. Compensation must be a fixed amount – and it should be crystal clear to the public.

Let me repeat that: If your employee, John Doe, earns $35,000 a year, then his compensation is $35,000 a year. Period. It should not depend on how much revenue the organization brought in. That includes “performance bonuses,” “discretionary incentives,” or whatever creative term you think will fly. It won’t.

Answer “yes” to these questions, and hell will break loose – fast.

Do you or will you purchase any goods, services, or assets from any of your officers, directors, trustees, highest compensated employees, or highest compensated independent contractors?

The answer is no, again. You’re doing this to help others – not to create a side hustle for your board or staff. Insider transactions in nonprofits are red flags for corruption, and the IRS has a sharp eye for this kind of abuse. Doing it is basically asking for a world of pain.

The IRS is banking on the fact that you understand this: doing business with your own officers, directors, or employees is frowned upon – and in many cases, outright illegal. A nonprofit exists to benefit the public. A for-profit exists to benefit its owners. Don’t mix the two.

Understand these best practices, and follow them.

(Next Step) Form 1023 Part VI – Financial Data & Budgeting

(Previous Step) Form 1023 Part IV – Narrative Description & Your Activities

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.