Do you have to file Form 990?

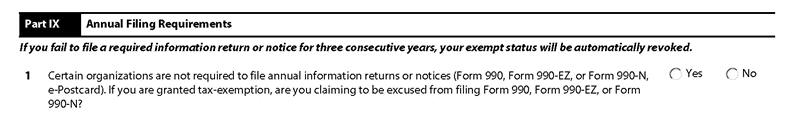

Form 1023 Part IX, Certain organizations are not required to file annual information returns or notices (Form 990, Form 990-EZ, or Form 990-N, e-Postcard). If you are granted tax-exemption, are you claiming to be excused from filing Form 990, Form 990-EZ, or Form 990-N?

The answer is a big fat NO. If you say yes, you’re just asking for questions you don’t want to answer. The safe move is to say no, whether you plan to file or not. Here’s the rule: if you make more than $50,000, you have to file the full Form 990; if not, you file the 990-EZ or 990-N (e-Card).

Almost all organizations must file some flavor of Form 990 unless they fall into one of these categories:

An integrated auxiliary of a church, as described in Regulations section 1.6033-2(h);

The exclusively religious activities of a religious order; or

An organization whose gross receipts are normally $5,000 or less and that supports a 501(c)(3) religious organization.

Take the time to understand your annual filing obligations as a tax-exempt organization. The penalties for failing to file or filing late are severe and should be avoided at all costs. For the sake of the Form 1023, check No and move on — unless you’re a church.

Churches usually don’t have to file Form 990 thanks to the separation of Church and State, which trumps transparency and equality.

(Next Step) Instructions For Form 1023 Part X – Signature And Uploading Your Attachments

(Previous Step) Form 1023 Part VIII (8)- Effective Date, 27 month Rule

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.