Definitions of Employee & Independent Contractor and Their Classifications

Beside employees and Independent contractors, nonprofits deal with volunteers as well, and the definition and subject of volunteers is as complex as paid workers.

Beside employees and Independent contractors, nonprofits deal with volunteers as well, and the definition and subject of volunteers is as complex as paid workers.

Please read through the differences of volunteers, interns, and employees and what the law says about compensations and benefits for each class as well.

Nonprofit employees and independent contractors classifications are extremely important because of the taxes paid and unpaid for each class, and mistaking these classifications would result in severe penalties from the IRS.

Who are considered employees in a nonprofit organization?

An employee for federal tax purposes is defined as a person that his employer has the right to tell him what to do and how to do it. This right to control is important, even if it is not exercised.

Who are independent contractors?

An independent contractor is self-employed, carrying on an independent trade or business. A nonprofit organization has some right to direct or instruct an independent contractor, but less than with an employee. An independent contractor has a genuine possibility of profit or loss. An employee who receives a salary does not normally incur business losses.

Do Nonprofits Pay Employment Taxes?

An exempt nonprofit organizations withhold and pay federal employment taxes under the same rules as other employers. Nonprofit 501c3 organizations that pay wages to employees must withhold, deposit, and pay employment tax, including federal income tax withholding and Social Security and Medicare (FICA) taxes. If total compensation paid to an employee of an exempt nonprofit organization is less than $100 in a calendar year, however, that compensation is not subject to FICA tax.

Nonprofit 501c3 organizations do not pay federal unemployment (FUTA) taxes on the wages of their employees, but other exempt nonprofit organizations do. Any person who fails to withhold and pay employment tax may be subject to penalties.

Nonprofit Worker Status: Employee or Independent Contractor

An employer generally does not have to withhold or pay taxes on payments to independent contractors. But if a nonprofit organization incorrectly classifies an employee as an independent contractor, it may be held liable for the tax.

Understanding classification is essential to fulfilling legal responsibilities for withholding and information reporting on workers.

Nonprofit Worker Classification: Three Categories of Evidence

Nonprofit Worker classification is determined by the relationship between the entity and the worker. The IRS has developed three categories of evidence to determine if a worker is an employee or an independent contractor. Often some facts will favor employee status and some will favor independent contractor status. To make a correct determination, an entity must consider both the evidence for autonomy and the evidence for right to control.

The three specific categories of evidence are:

- Behavioral control

- Financial control

- Relationship of the parties

Let’s explore each category:

Behavioral Control

The factors showing the right to direct or control how the worker performs the task are:

- Instructions – An employee is generally subject to the organization’s instructions about when, where, and how to do the work; what tools or equipment to use; what order or sequence to follow;

- Training – An employee may be trained to perform services in a particular Independent contractors ordinarily use their own methods.

Financial Control

The factors showing the right to direct or control the financial aspects of the worker’s activities include:

- Significant Investment – An independent contractor often has a significant investment in the facilities used in performing services for someone Does the worker own the standard tools and equipment of the trade or profession? Is there a significant investment in equipment? Does the worker maintain a separate office?

- Un-reimbursed Expenses – Independent contractors are more likely to have un-reimbursed expenses than Does the worker hire and pay helpers?

- Services Available to the Relevant Market – An independent contractor is free to seek out business Does the worker advertise and maintain a visible business location?

- Method of Payment – An employee is guaranteed a regular wage amount for an hourly, weekly or other period of An independent contractor is usually paid a flat fee for a job.

- Opportunity for Profit or Loss – An independent contractor can make a profit or

Relationship of the Parties

These factors show how the parties perceive their relationship:

- Intent of the Parties/Written Contracts – A written contract specifying employee or independent contractor status is important However, the entire substance of the relationship must be considered.

- Employee Benefits – Providing a worker with typical employee benefits (e.g., health insurance or a pension plan) is evidence of employee

- Discharge/Termination – Can the firm terminate or discharge the worker or can the worker leave before the task is completed without becoming liable for nonperformance under the contract or agreement? These facts suggest employee

- Regular Business Activity – Are the services an important aspect of the regular business of the entity? If so, an employer-employee relationship may be indicated.

State or Other Federal employee Classification Requirements

Different federal and state agencies make determinations of nonprofit employee classification based on the facts of each case and the applicable law. IRS determinations may differ from those of state government agencies. If an exempt nonprofit organization plans to classify some workers as independent contractors, it may want to obtain a separate ruling from each agency.

Employees and Non-Employees – Defined by Statute

The following positions are classified as employees or independent contractors by law:

Corporate Officers: A corporation officer is an employee unless he/she performs no services, or only minor services, and neither receives nor is entitled to receive any remuneration, directly or indirectly. Corporate officers include presidents, vice presidents, treasurers, etc. This is so even if:

- The officer is the sole shareholder and, as such, controls his or her own duties and

- The officer is supplied by a leasing

Corporate Director: A corporate director is an independent contractor.

Now that we understand the difference between each class of workers in a nonprofit organization, we can explore the complex laws concerning compensations of each class, and tax forms to be used including penalties.

When a nonprofit worker is Considered an Employee Scenario

Example 1: The MNO Little League organization hired coaches selected by the League’s officers. The board sets the times and places for all the games. The coaches are fathers or mothers of the children who play on the team. The organization has established policies and procedures that coaches are required to follow. Generally, the officers do not interfere with the coaching unless there is a problem. The coaches receive $500 per season.

Question: Would these coaches be employees or independent contractors of the nonprofit?

Answer: Given the facts in this scenario, the coaches are employees.

Example 2: PQR Theatre places the following advertisement in the newspaper.

Needed: ushers, ticket takers, and ticket sellers. Hourly rate is negotiable based on experience and reliability.

Question: Would these workers be employees or independent contractors of the nonprofit?

Answer: The ushers, ticket takers, and ticket sellers are all employees of PQR Theatre.

Example 3: The STU Foundation hires van drivers to transport physically disabled individuals to their doctors’ appointments. The STU Foundation owns the vans, pays the insurance and all other related expenses for the vans, and uses the vans only for this purpose. The van drivers are not allowed to take side trips. Their purpose is solely to transport physically disabled individuals to their doctor’s appointments.

Question: Would these drivers be employees or independent contractors of the nonprofit?

Answer: The van drivers are employees of STU Foundation.

When a worker is considered an Independent Contractor Scenario

Example 1: The STU Foundation hires van drivers to transport physically disabled individuals to their doctors’ appointments. The drivers own their own vans and pay for the gas, insurance and maintenance. The drivers charge $1.00 per mile and are willing to stop anywhere.

Question: Would this person be an employee or independent contractor of the nonprofit?

Answer: The van drivers are independent contractors.

Example 2: GHI Private School for the Gifted hired a janitor to clean up the school after hours. The janitor must provide all necessary equipment and supplies. He may come in and clean anytime that school is not in session but must come in at least three times per week. The janitor is provided a key to the school. The school is billed monthly for the services of the janitor. The janitor has several other clients.

Question: Would this janitor be an employee or independent contractor of the nonprofit?

Answer: Given the facts in this scenario, the janitor is an independent contractor.

Example 3: DEF Country Club, Inc., is looking for an experienced accountant who specializes in working with tax-exempt organizations. The accountant must be able to prepare a compilation of the financial statements on a monthly basis, present these statements to the board of directors at the monthly meetings, perform the annual gambling audit, and prepare the form 990 and 990-T returns at the end of the year by the due date.

Question: Would this accountant be an employee or independent contractor of the nonprofit?

Answer: Given the facts in this scenario, the accountant is an independent contractor.

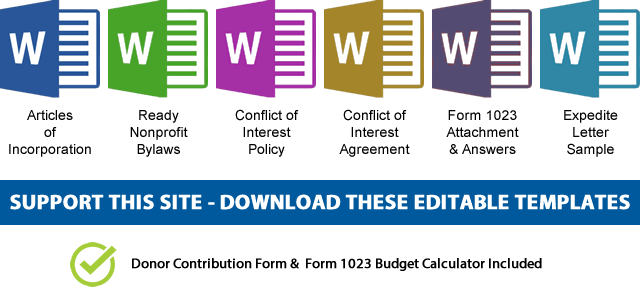

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.