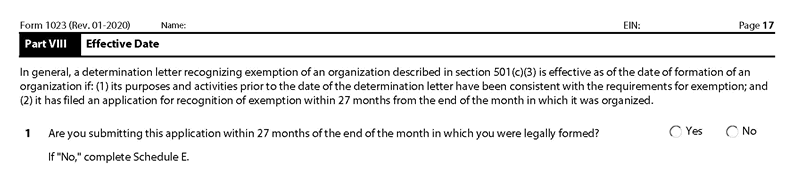

Form 1023 Part VIII (8) Are you submitting this application more than 27 months after the end of the month in which you were legally formed? If “Yes,” complete Schedule E.

Now, about the 27-month rule: generally, your organization has 27 months from its formation date to apply for tax-exempt status. If you apply within this window, your exemption can be retroactive to the date you officially incorporated, meaning you won’t owe federal income tax for that entire period.

Miss that giant two-and-a-quarter-year deadline? Well, you’re not automatically screwed, but you better have a good explanation. The IRS isn’t going to just wave it away. They expect a reasonable cause for the delay, like honest confusion, unforeseen circumstances, or professional advice that went wrong. Simply ignoring the 27 months deadline or waiting too long without justification can mean your exemption only starts from the date you filed, or worse, denial altogether.

This might not matter much if your organization’s income was close to zero during that period, but if you had substantial revenue, you’re on the hook for unpaid corporate taxes.

If you find yourself applying late, you need to address the delay upfront in your application. Provide a clear, concise explanation, supported by any evidence you can muster. This shows the IRS you’re serious and acting in good faith, not trying to game the system.

Bottom line: don’t panic if you missed the deadline. Apply anyway and come prepared. Your chances of approval don’t drop dramatically just because you’re late – the IRS simply won’t backdate your exemption to your incorporation date. Instead, your tax-exempt status will start from the date they approve your 501(c)(3) application.

And if you’re a church, this doesn’t really matter – you were automatically exempt anyway, file away with no worries.

And yes, you’ll need to complete Form 1023 Schedule E, which covers requests for retroactive exemption and explanations for the delay.

Please see the complete instructions for all the IRS Form 1023 Schedules.

(Next Step) Form 1023 Part IX – Annual Filing Of Form 990 Requirements

(Previous Step) IRS Form 1023 Part VII (7) Foundation Classification

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.