Why are Churches “almost” immune to IRS Audits

Churches, are neither obligated, nor willing to share ANY financial information with the public, their own members and congregation, or anyone else for that matter. It’s crucial to mention that Churches enjoy “automatic tax exemption”, NOT by due process or paying fees, like every other exempt organization, but as an implicit and god-given “right.”

Let me rephrase that again, because it’s awfully important. Churches don’t pay a single dollar in taxes. They don’t disclose any financial information that every other exempt nonprofit organization in the country is subjected to by law such as the Form 990, and they publicly influence legislation, and support and oppose political candidates nationwide on regular basis. They shouldn’t, but they do.

So, where does the IRS stand when it comes to conducting investigations into Church matters that “automatically” regards exempt from paying taxes? The following is straight from the mouth of the IRS.

The IRS may only initiate a Church tax inquiry if a high-ranking IRS official, reasonably believes, based on a written statement of the facts and circumstances, that the organization:

- (a) may not qualify for the exemption; or

- (b) may not be paying tax on unrelated business or other taxable activity.

Which means, the IRS, mandated by the congress, will look into wrongdoing of a Church, only if the scandal makes the national headlines. This implies that when a Church goes rouge, only God should be the judge, whether it is raping altar boys or evading billions in taxes. It’s simply appalling.

The trouble with Church Automatic Tax Exemption

Some of you might not even be old enough or care enough to remember Heritage USA, a “Christian” theme park which was erected from the tax dollars of the American people for the sole enjoyment and amusement of the faithful by Praise The Lord Club (PTL), in Fort Mill, South Carolina. I used to live three miles from the site and the events are still a vivid memory for many Carolina residents.

Founded by televangelist Jim Bakker and his criminal wife, Tammy Faye Bakker, Heritage USA was no ordinary establishment. Averaging $120 million dollars in revenue per year, HUSA was a top vacation-destination only behind Disneyland, and it was the heaven on earth for every living Christian soul, including their dogs.

Jerry Falwell, the controversial Baptist televangelist, monumentally raised over $20 million dollars in one single fundraising drive to show his support for PTL, and his historic plunge down the 163ft water slide of the park became national news. Everything was good and holy, until its founder Jim Bakker raped the famous Playboy model Jessica Hahn, and tried to silence her by paying her $287,000 out of organization funds. This time national attention on the fiasco became too much for the IRS to ignore, like it always does. This time the IRS came through by auditing the embarrassing church scandal and revoked their (of course, automatically granted) exemption status.

The Charlotte Observer ran exposes of PTL’s finances and management practices. Pictures and footage of an air-conditioned doghouse emerged from the home of Jim and Tammy Faye, and PTL went bankrupt after being taken over by Jerry Falwell, who offered to step in following the scandal.

- Under the “good and honest” Falwell’s leadership, Heritage USA sought chapter 11 bankruptcy protection with debts estimated at 72 million dollars. The 165,000 people who each gave $1,000 (a mighty sum of 165 million dollars) to Jim’s planned hotel tower (in return for promised four-day vacation stay) each received only $6.54 in return. One hundred and sixty four million dollars vanished into the thin air right under the nose of the IRS through their automated church tax exemption scheme.

Jim Bakker was found guilty on 24 counts of fraud and conspiracy, fined $500,000, and spent less than 5 years in prison. Tammy Faye, continued to sell imaginary-houses in heaven above on live television, despite being an accessory to this abomination, until her timely death from a fate-earned Colon Cancer in 2007. Jerry Falwell went on to hold an “special place” in American History for saying and doing dim-witted things that made George W. Bush appear like Aristotle. And this scandal was, and is, one of the smaller scale frauds that go on every day from Mississippi to California.

Church corruption, a question of morality vs. legality

If you got to this point, I’m sure you’re sharpening your knives and want nothing more than my blood, but in my defense, I’m not oppose to church tax exemption, I’m all for it. However I’m vehemently oppose to automatic exemption because the standard to measure the sincerity is based on absolutely nothing.

Churches should be exempt from taxation because of the good that they do. And the wonderful things that they do far outweighs the malicious activities of corrupt churches. Not all churches should be hit by the same stick, far from that, there are many good men of god who do such selfless work in the worst conditions humanly possible that no government Agency would even consider doing.

I ask this question in all sincerity; how can anyone differentiate between an honest-to-god church and bible banging multi-million dollar mega businesses that are also considered churches? As long as the automatic tax exemption is awarded to every schmuck who puts a cross on a building and calls it a church, you simply cannot.

As true Christians we are obligated not to impose our legal and social responsibilities on others, yet there are some who claim Christianity and as long as they are exempt from paying taxes, morality goes out of the window.

And some people may think this is a small sum of money that can be waived. Taxes on real estate holding and assets of the Catholic Church alone could balance the Federal budget deficit or feed the poor of the world a several lifetime over. These are unpaid and dodged taxes on properties and activities that are strictly unrelated to anything charitable or godly.

- They operate profit making businesses, like parking lots, billboard lots, gymnasiums, fast-food restaurants, stadiums, wedding halls,… and they don’t pay their taxes, because it’s their god given right, until they get caught once in a blue moon. Then their cries go up to the heavens on how the Church was betrayed by the government and they can’t wait to ask the very same government they try to “keep out”, to punish the whistle blowers.

Why does the IRS fail to prevent such disasters?

Because the IRS has been told to let-it-slide for so long that it has become a twisted normality. It’s not because there are no patriotic people in the IRS, or that it is a corrupt branch of the government. No, they fail because they can’t do anything even if they want to. The IRS follows the laws set for it by the congress which implicitly do not permit interference with Churches.

If your neighborhood nonprofit CEO rode around in a custom designed bulletproof Mercedes worth over 1/2 million dollars, and if he had a butler to put on his socks and attend to his needs 24/7, and if he had a personal chef to exclusively prepare his meals, and if he had a personal physician on location at all times, and if he had a slave to hold an umbrella over his head when it rained, and if he wore a funny red hat,…

I wonder if even one person with sound mind would even think of donating a black penny to such a person. But somehow people sign over their paychecks to an establishment with a head figure that does all the above using tax payers’ money, just because he is called the Pope!

And of course, who is the IRS to go after the Pope and company? But don’t make a mistake; a religious ministry is not a church, and it doesn’t enjoy the immunity that churches have. All religious organizations are fair game except churches.

Special Rules Limiting IRS Authority to Audit a Church

Congress has imposed “special” limitations, found in IRC Section 7611, on how and when the IRS may conduct civil tax inquiries and examinations of churches.

Restrictions on Church Inquiries and Examinations

Restrictions on church inquiries and examinations apply only to churches (including organizations claiming to be churches if such status has not been recognized by the IRS) and conventions or associations of churches. They don’t apply to related persons or organizations. Thus, for example, the rules don’t apply to schools that, although operated by a church, are organized as separate legal entities. Similarly, the rules don’t apply to integrated auxiliaries of a church.

Restrictions on church inquiries and examinations do not apply to all church inquiries by the IRS. The most common exception relates to routine requests for information. For example, IRS requests for information from churches about filing of returns, compliance with income or Social Security and Medicare tax withholding requirements, supplemental information needed to process returns or applications and other similar inquiries are not covered by the special church audit rules.

Restrictions on church inquiries and examinations don’t apply to criminal investigations or to investigations of the tax liability of any person connected with the church, such as a contributor or minister.

The procedures of IRC Section 7611 will be used in initiating and conducting any inquiry or examination into whether an excess benefit transaction (as that term is used in IRC Section 4958) has occurred between a church and an insider.

Church and religious organizations Audit Process

religious organization can be audited like any other exempt organizations and I’ve outlined the nonprofit IRS audit process in detail. However the sequence of the audit process for a church is a little different:

- If the reasonable belief requirement is met, the IRS must begin an inquiry by providing a church with written notice containing an explanation of its concerns.

- The church is allowed a reasonable period in which to respond by furnishing a written explanation to alleviate IRS concerns.

- If the church fails to respond within the required time, or if its response is not sufficient to alleviate IRS concerns, the IRS may, generally within 90 days, issue a second notice, informing the church of the need to examine its books and records.

- After issuance of a second notice, but before commencement of an examination of its books and records, the church may request a conference with an IRS official to discuss IRS concerns. The second notice will contain a copy of all documents collected or prepared by the IRS for use in the examination and subject to disclosure under the Freedom of Information Act, as supplemented by IRC Section 6103 relating to disclosure and confidentiality of tax return information.

- Generally, examination of a church’s books and records must be completed within two years from the date of the second notice from the IRS.

If at any time during the inquiry process the church supplies information sufficient to alleviate the concerns of the IRS, the matter will be closed without examination of the church’s books and records. There are additional safeguards for the protection of churches under IRC Section 7611. For example, the IRS can’t begin a subsequent examination of a church for a five-year period unless the previous examination resulted in a revocation, notice of deficiency or assessment or a request for a significant change in church operations, including a significant change in accounting practices.

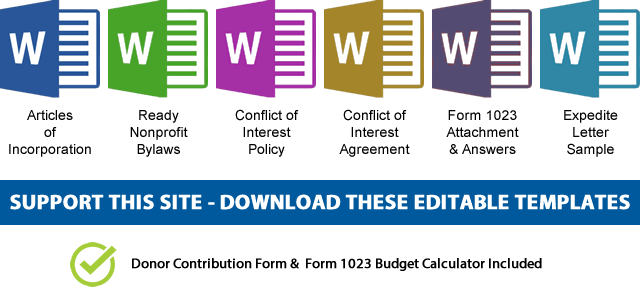

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.