The first step in starting a 501c3 nonprofit organization is to incorporate the nonprofit in your Resident State.

The first step in starting a 501c3 nonprofit organization is to incorporate the nonprofit in your Resident State.

I say Resident State because there is so much misinformation regarding where to incorporate your 501c3 nonprofit and is fueled by companies who know nothing about nonprofit incorporation.

If you don’t take anything away from this article, just take the following to heart:

DON’T PAY FOR NONPROFIT INCORPORATION SERVICES.

Basically Incorporating a Nonprofit Organization is done following 4 easy steps:

- Reserve the name.

- Download the Nonprofit Incorporation form.

- Attach the minimum required language for the IRS.

- Mail your nonprofit Articles of Incorporation.

So how do we get there and what to avoid? There are hundreds of Incorporation Companies out there, many with big names and colorful charts to take thousands of dollars of your hard-earned money for something that takes 5 minutes to do and costs nothing. Many of these incorporation companies, the ones that I don’t even have to name, have packages for 501c3 Nonprofit Incorporation – Economy, Standard, Silver, Gold express,… like you’re buying a greyhound bus ticket or they’re sending you on a cruise vacation.

How much does it cost to incorporate a nonprofit?

Let me spell it out for you; Nonprofit Incorporation is the easiest, simplest, and the least expensive part of your nonprofit organization formation. Every State charges a different fee for incorporation but on average it’s about $50 all said and done. If you pay a penny more than that to anyone else you’ve been had.

Should you incorporate a nonprofit out of your own State?

The main reason that almost every online incorporation service pushes you to incorporate your nonprofit out of State, mainly in the State of Delaware, is because it’s easy for them to do so, NOT because it’s to your benefit.

You’re incorporating as a non-profit; not a for-profit entity. There are no tax breaks, favorable business courts,… You get ZERO benefit from incorporating your nonprofit out of State and a million and one headaches and unnecessary costs from doing so.

To give you an example; If you incorporate in the State of Delaware and your office is in Texas, you have to pay a company (The bozos above) to be your Registered Agent. They charge several hundred dollars a year just for that, when they actually don’t do a damn thing. They will also charge you for annual reporting to the State, something that takes less than 5 minutes every year. That was just one example. Incorporate yourself in your Resident State. Enough said.

Incorporating a nonprofit in the State of California

If you’re incorporating a nonprofit in California, you’re very lucky as the State of California is the only state that already has the required provisions for the IRS built in its articles of incorporation (incorporation form). There are absolutely nothing extra that you have to include with your articles of incorporation for the sake of the IRS. The only exception is for private foundations.

Assuming that you’ve already read the How to Start & Form a 501c3 Nonprofit Organization Ultimate Guide, let’s start incorporating your non-profit.

Here’s How to Incorporate a Nonprofit Organization:

Step 1. Reserve the Name for the corporation

Go to your Secretary of State Office website (Find your State from bottom of this page) and do a Business Name Search. If your name is not taken, well, you got your name.

Total time: 5 Minutes. Cost: $0.

Step 2. Download the FREE Nonprofit Incorporation Form.

Download the form for Incorporation of Nonprofit from your Secretary of State Office Website, fill it out with your name, phone number, addresses, and your Mission Statement. Your state may have an online incorporation portal but make sure that you can add additional articles if that’s the case.

Total time: 10 Minutes. Cost: $0

Step 3. Attach the minimum Required Language for the IRS

Attach the minimum required provisions language for the IRS (Purpose and Dissolution Clause). If you like to add more information on your incorporation which I highly suggest, you can use the Complete Articles of Incorporation from this site as an attachment. I strongly recommend this, but as long as you attach the required provisions language for the IRS Purpose and Dissolution Clause, you’re golden.

Total time: 5 Minutes. Cost: $0

Step 4. Mail or file your Incorporation Form

Mail it. (Don’t file online unless your state gives you the option to include the required language in their online form or as an attachment). This is very important otherwise you’ll have to amend your articles of incorporation later.

Total Cost: A single Stamp and whatever your State charges you for Incorporation Fees (average of $50).

So Incorporate a nonprofit yourself in your Resident State, a monkey can do it and so can you. And I do hope that you get offended, at least it will save you thousands of dollars.

Here's the website addresses of all 50 Secretary of States:

(Next Step) Nonprofit Articles Of Incorporation Sample, How To Write One

(Previous Step) How To Start a Tax-Exempt Nonprofit Organization

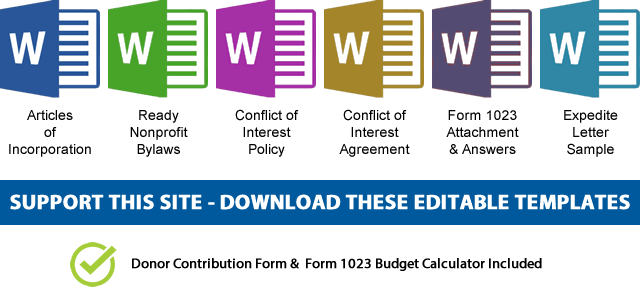

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.