Amendments to Nonprofit Articles of Incorporation

An existing nonprofit corporation may need to amend its nonprofit articles of incorporation or certificate of formation from time to time to reflect changes to the corporate structure such as name changes, or to provide additional legal information such as IRS required provisions necessary for applying for 501c3 tax exemption.

An existing nonprofit corporation may need to amend its nonprofit articles of incorporation or certificate of formation from time to time to reflect changes to the corporate structure such as name changes, or to provide additional legal information such as IRS required provisions necessary for applying for 501c3 tax exemption.

Most states allow amendments to the articles of incorporation as long as the articles being amended contain only such provisions as could have been included in the original instrument of organization, and doesn’t contradict state laws.

Amendments may be adopted to change the language of an existing provision, to add a new provision, or to delete an existing provision. If extensive amendments are proposed, you should consider filing a restated certificate or articles of incorporation.

When you should Amend your nonprofit Articles of Incorporation

Unless the nonprofit articles of incorporation or certificate are being amended for major reasons; amendments to the nonprofit articles of incorporation shouldn’t be used for notifying the incorporating state of changes in directors positions, addresses, or other trivial matters.

- This sort of changes should be reported at the end of every year when the corporation is filing its annual report with the State.

Amending the articles of incorporation is not free and in most states, filing amendments actually costs more than the incorporation itself, so use it wisely.

How to Amend the Nonprofit Articles of Incorporation

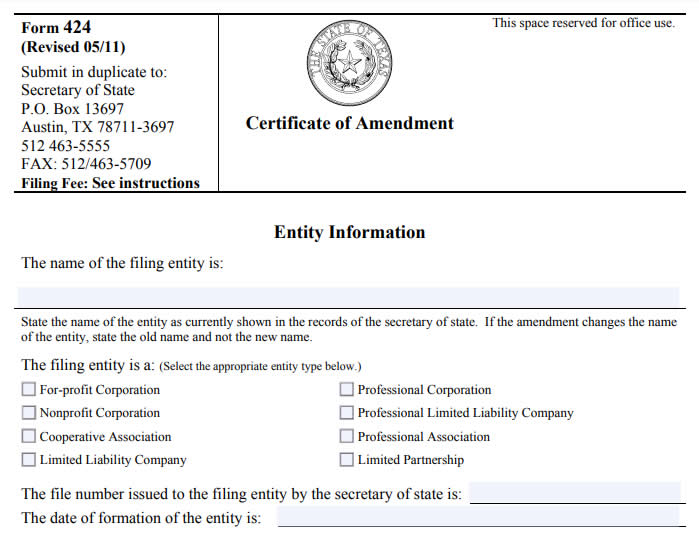

An amendment to the nonprofit articles of incorporation is normally done through a legal instrument called the Articles of Amendment or in some cases such as the State of New York or Texas; Certificate of Amendment. Every state has its own flavor of amendment form, but the procedure is universally the same. The most important thing is to find the right form for the right kind of entity.

Find the right amendment form

Since we are strictly talking about nonprofit corporations here, you have to find the right amendment form which should clearly state that it’s for amending a nonprofit or not-for-profit articles of incorporation. You cannot use a general corporation amendment form for this purpose as your Secretary of State will reject it.

Once you have the right amendment form, you have to take a close look at the original nonprofit articles of incorporation and find out the article and section numbers of the clauses you’d like to amend, and then reflect those changes on the amendment form.

Be clear on what you’re amending

For example, let’s say that you’d like to amend the purpose clause and the dissolution clause of the existing nonprofit articles of incorporation. You have to be very clear whether these articles are being deleted, or a new article is being added, or they are just being modified to some extent.

- Most states do this through their corporation amendment form and you have to pay very close attention to the instructions of the articles of amendment. No two states are the same. Most states accept amendments online but some don’t such as the State of Florida and New York (at the time of writing this article at least). In this case you have to download, complete and then mail it back to the Secretary of State.

Below is a sample of nonprofit articles of amendment from the state of Texas so you know what the form looks like.

Restatement vs. Amendment of the nonprofit articles of incorporation

You may be given an option to choose whether you want to restate or amend your nonprofit articles of incorporation by your state. Most states which have an online portal for these processes offer this option and you should be aware that they are not the same thing.

- Restating is the act of completely replacing the entire nonprofit articles of incorporation with a new version whereas amending is just adding and subtracting specific portions of organizing clauses. If you’re restating the articles of organization, the process is exactly the same as incorporating a new entity which I have explained in the articles of incorporation page.

For the sake of 501c3 tax exemption, you’re most likely amending your articles to include the required language by the IRS for 501c3 exemption, so restatement is usually unnecessary and not needed.

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.