How to calculate and project your budget on the IRS Form 1023

The Form 1023 budget and financial section is a big deal. Part VI (6) accounts for about 90% of the information the IRS uses to determine whether you’re a public charity or a private foundation.

If you’re already an existing nonprofit, this should be easy – you’ve got real financial data from past years, and your budget projections should practically write themselves.

But if you’re a brand-new organization applying for tax-exempt status, Part VI (6) will look outrageously confusing. You have no financial history, yet you’re somehow supposed to provide detailed projections. Don’t get too worked up – it’s for your own good.

Part VI (6) of the IRS form 1023 has to be done with utmost professionalism. No IRS examiner will take your organization seriously if you hand draw your tables or list your data in an incoherent way. Remember that the Form 1023 budget is part of a public document so you have to do your best.

You need to project your financial data and organization’s expenses from A to Z, and put them down in tables. Do not use the actual Form 1023 for the financial data explanations on line 25 (itemized financial data); this section should go in your Form 1023 attachment called the supplemental responses.

Even though you have no financial records, you still need to provide your past (even if it’s just buying lunch for the board), your present, and at least two or three complete years into the future. This is where you, and your treasurer have to get creative with budget projections and make up numbers. Yes, I said make up numbers, because there’s really no other way to put it.

You’re being asked to speculate – plain and simple – on what you’ll earn, what you’ll spend, and what will be left over at the end of each year.

Form 1023 Budget Projection Calculator

After reviewing countless dreadful applications, I finally put together an automatic Form 1023 budget projection calculator to turn your financial projection from a two-week headache into a five-minute task. Click the button to the left to download the ZIP folder and get the calculator. It comes with a comprehensive explanation of the statements and should (hopefully) answer most of your endless questions.

After reviewing countless dreadful applications, I finally put together an automatic Form 1023 budget projection calculator to turn your financial projection from a two-week headache into a five-minute task. Click the button to the left to download the ZIP folder and get the calculator. It comes with a comprehensive explanation of the statements and should (hopefully) answer most of your endless questions.

The calculator is in Microsoft Excel format and is fully printable.

Read the budget and financial instructions 100 times if you have to — and make your projections wisely. This calculator isn’t available anywhere else, and I’ve spent a ridiculous amount of time perfecting it. So don’t forget to donate a few dollars to help keep this site alive.

Why does the IRS ask for a projected budget on the form 1023?

The IRS wants to see the percentages of your proposed revenue and expenses in your Form 1023 budget, not just to verify your math, but to determine your foundation classification, whether you have unrelated business income, or if you’re funneling benefits to insiders. The actual dollar amounts? They’re largely irrelevant, despite what most people think.

You could submit a $10,000 revenue projection on your Form 1023 and still get denied, while someone else walks in with a $3 million budget and gets approved without a hiccup. It all comes down to how you present your numbers — and what those numbers reveal about your activities.

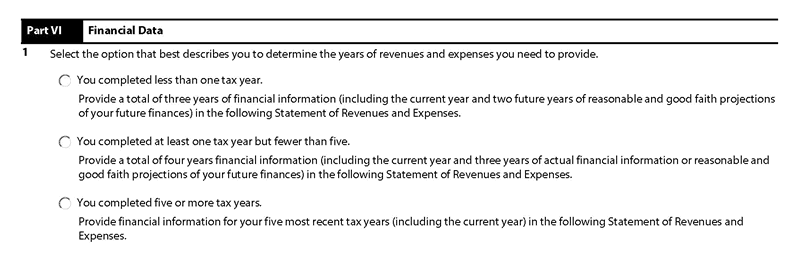

How to fill out the Part VI of the form 1023 (Financial Data)

A few form 1023 financial budgeting tips first:

Choose your projections wisely. Whatever your total projected revenue is, at least 85% of it should go toward your actual programs. If it doesn’t, cut your expenses. A decent nonprofit should allocate no less than 85% of its budget to doing the work — not running the office. If you’re projecting more than 15% in internal overhead, something is seriously wrong with your organization – or with your priorities.

Don’t project too high or too low. Don’t claim your revenue will be $180,000 a year if you know that’s a long shot in hell. It’s better to project small, realistic figures. The IRS isn’t going to knock on your door just because you made more money than you truthfully anticipated.

Make sure your numbers match. Whatever amounts you list in the Form 1023 financial data table must exactly match the numbers in your attached budget sheet. If they don’t line up, you’re going to get questioned.

The following is an example of how your Form 1023 financial data should be presented. Every table is clearly labeled, and each section directly relates to the questions asked on the form. Use the actual financial table on Form 1023, but in the itemized section, write “Please see attachment”, and then include a complete, detailed budget. If you don’t, you’ll be questioned to death.

A more hands-on explanation with Form 1023 budget examples follows:

Form 1023 Financial Data Part VI

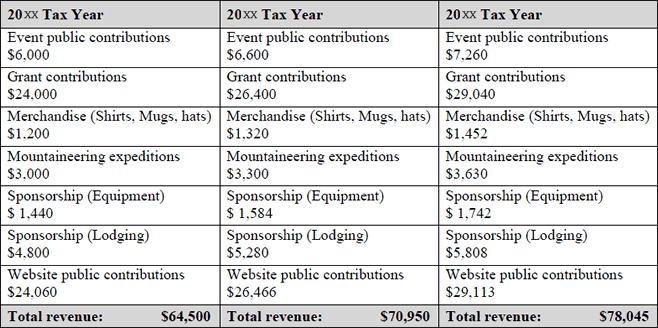

A) Statement of Revenues and Expenses and Projected Data for 20xx, 20xx, and 20xx Tax Years

Gross receipts from admissions, merchandise sold or services performed… in any activity that is related to your exempt purposes (attach itemized list.)

The following table consists of the projected gross income from monetary donations, grants and gifts to the organization. This includes the fundraising merchandise sales as well as services rendered. The table is sorted alphabetically.

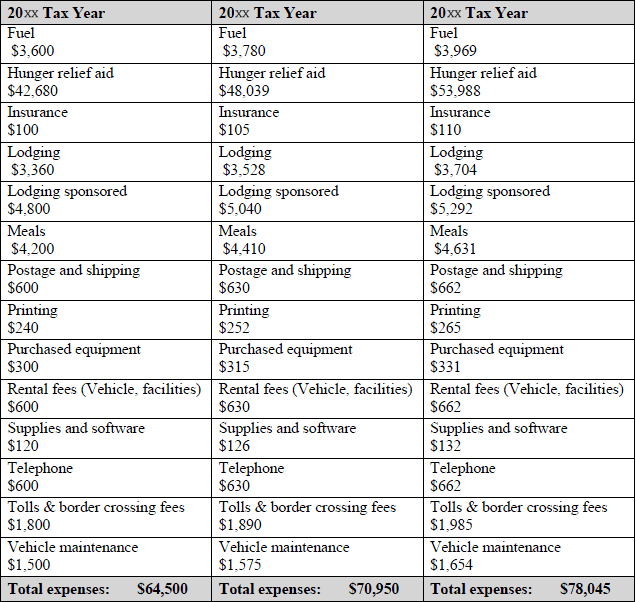

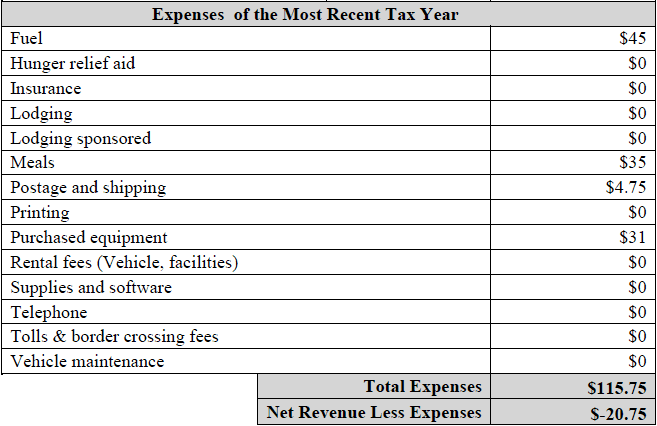

Form 1023, Part VI – Any expense not otherwise classified (attach itemized list.)

The following table consists of the organization’s expenses, expenditures and spending for the shown years. Please refer to the second worksheet for further itemization.

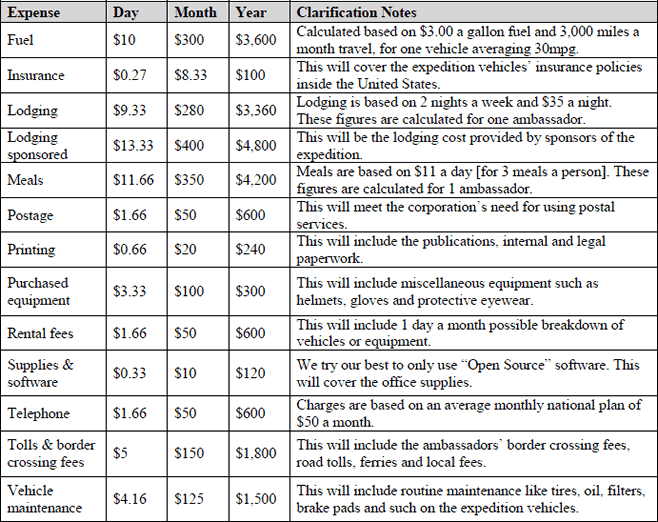

Further Breakdown of Expenses

Please note that the inflation rate for the years of 20xx and 20xx has been calculated based on a 5% increase annually.

B) Balance Sheet (for your most recently completed tax year)

Please note: The table below is an itemized list of the expenses and income of XYZ Humanitarian Corp. since its incorporation on XX,XX 20XX. The table is sorted alphabetically.

The last part is you asset sheet. You need to list anything and everything that your organization owns from chairs to automobiles.

(Next Step) IRS Form 1023 Part VII (7) Foundation Classification

(Previous Step) Instructions For Form 1023 Part V, Compensation

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.