What is Form 1023-EZ and does my organization qualify?

Streamlined Application for Tax Exemption or as it is most commonly called the Form 1023-EZ, is a three page 501c3 application form for tax exemption that tries to simplify the process of obtaining tax exemption for nonprofit organizations through an honor system by checking a few yes and no boxes and signing a somewhat of an affidavit implying what the applicant is saying is true, with no checks and balances, no reviews, and almost no human intervention on IRS’s part. We discuss the pros and cons of using the form 1023ez here and whether you should use this form.

Form 1023 EZ Streamlined Application for Recognition of Exemption:

When the IRS released its short and “easy or EZ” version of the Form 1023 (Form 1023 EZ the Application for Recognition of Tax Exemption under the 501c3 section of the Internal Revenue Code), it quickly became a bad joke and a failure on so many level that I don’t even know where to begin.

When the IRS released its short and “easy or EZ” version of the Form 1023 (Form 1023 EZ the Application for Recognition of Tax Exemption under the 501c3 section of the Internal Revenue Code), it quickly became a bad joke and a failure on so many level that I don’t even know where to begin.

In theory, most nonprofit organizations with gross receipts of $50,000 or less and assets of $250,000 or less are eligible to use the form 1023 EZ. This does not include churches, schools, hospitals, and many other types of organizations. Even if you do qualify, it doesn’t mean that you won’t need compliant organizing documents such as bylaws and conflict of interest policy.

The IRS compliance requirements stays the same and even more so.

There are many problems with the Form 1023-EZ, and the IRS astonishingly pushed it forward in record time and it’s been in effect for a long time now. Form 1023 EZ virtually opens up the once seemingly difficult process of obtaining tax exemption to the most undesirable organizations, liars, daydreamers, and pure idiots. Not only it will flood the nonprofit sector with useless mushroom like organizations, it will cut the funding for the real nonprofit organizations on a grand scale as anyone with $275 in his pocket can now apply for funding and solicit donations, tax free.

You can download the form 1023 EZ from here.

You can download the form 1023 EZ Instructions from here.

Who should file the Form 1023 EZ?

The simple and the only answer is minnow sized nonprofit organizations that don’t need any grants and very little money. Examples of these organizations would be small animal rescue organizations, little sport leagues for toddlers and alike. Almost every other type of nonprofits who are hell-bent on using the EZ form fall under misinformed or fraudulent intent category.

Form 1023 (Long version) vs. Form 1023-EZ

The long version of the Form 1023 is long for a reason. Sure it has its goofs and desperately needs to be revised even with the latest 2020 revision and taking it online, but it’s an education for the budding organizations that you CANNOT get from the Form 1023 EZ version.

It goes through many many scenarios and asks many questions to determine the applicant eligibility and intentions, while educating them with tax laws and pitfalls. Many applicants have ditched the idea of forming a nonprofit organization just reading half way through the form and they actually have made the right decision, saving themselves the application fee and heartaches down the road.

Assuming that you’ve read my guide on starting a nonprofit 501c3 organization, you already should know that running a nonprofit organization is not for everyone, not even by a long shot, and the Form 1023 EZ makes it unrealistically easy for everyone to take a failing crack at it. By using the Form 1023EZ you might get approved faster but fail you will. Mark my words.

What are the downside of the Form 1023EZ?

Since the roll out of the 1023-EZ, grant and funding foundations are adopting safeguards and adding anti 1023 EZ practices to their application approval process. Some are outright asking whether you filed using the EZ form or the complete version.The level of fraud that exists in these shell organizations who used the 1023 EZ is staggering and States and funders are ramping up their scrutiny.

For example one of the qualification clauses for using the Form 1023-EZ is that your organization CANNOT maintain separate accounts for donors to advise how the funds will be spent! Well I hate to break it you, but almost all grants, small or large, have stipulations on how the money should be used.Which means that if you ever want to apply for a grant, you CANNOT use the Form 1023EZ. You should ALWAYS honor special requests, notes, terms, and conditions which are specified by contributors and should maintain a separate account for that specific donation.

27 months tax-exemption backdating rule doesn’t apply to Form 1023 EZ

Nonprofits generally have 27 month from the date of incorporation to apply for tax exemption using the form 1023. If that 27 months has passed, the long form 1023 has an option to complete Schedule E and ask the IRS to backdate exemption status to the incorporation date. Form 1023 EZ does not have this option and if the 27 months has passed, you may end up paying taxes on all the revenue for 3 years.

Form 1023 EZ increases the chance of getting audited by the IRS a million-fold

The main reasons mentioned by the IRS for creating this joke of a form is to decrease application review time by shifting the attention from reviewing applications to auditing nonprofit organizations. Who do you think they will audit first? An organization that filed the long 1023 form and has given every detail about their existence and plans, or the organization that is virtually untested and unknown on every aspect?

Organizations tend to underestimate their income on 1023-EZ

Almost 7 out of 10 applications that I review has intentional and illegal budget miscalculation and people do it to get away with paying $325 less for the application fee. One of the qualification clauses on the Form 1023EZ is that your organization CANNOT have more than $50,000 gross income in ANY given year for the next consecutive three years after filing your application.

Pay close attention to the 3 years requirement because it does not include the current tax year that you’re applying. From my experience, a large majority of nonprofit organizations that budget and receive less than $50,000 a year will fail in the first two years and will dissolve the organization. The reason for that is that they have a dream of doing something but don’t have the ability to raise the funds or the comprehension that helping others requires money.

You simply cannot run a Falafel stand with $50,000 gross income let alone a nonprofit organization. Let’s assume you have a Falafel stand and you sell 60 Falafel a day at $4 apiece. Your gross income based on 5 days a week for one year is $60,000! That’s even assuming that you have no rush-hour and you don’t live in New York City.

Form 1023 EZ may land you in prison

The Form 1023 EZ makes it a fool-proof way of obtaining federal 501c3 tax exemption status virtually overnight and start collecting tax deductible donations from unsuspecting donor for your own benefit. Not only has the form 1023-EZ made the dishonest applicants grow exponentially, the EZ version of the form 1023 has created a secondary nightmare of enabling marketing crooks to pitch their tax exemption services to honest unsuspecting applicants who don’t know any better.

I’ve lost count of how many times I’ve heard someone telling me that so and so “CPA” or “nonprofit coach”, or some “nonprofit workshop” suggested using the form 1023EZ to an applicant who actually didn’t qualify by a mile. Don’t take the advice of these people, they are after your money and they know that they’re lying to you.

- Just recently I was told by a client that she hired a person to do her application and even though the projected budget of the organization was over $300,000, this person suggested to use the form 1023EZ and not worry about it, as they could just report the actual revenue on their form 990 at the end of the year and nothing would happen.

The IRS examiners are not stupid. If you’re banking on their ignorance, you better think again. Not only you’ll be audited, your exemption status will be revoked, and now you have a criminal case against you for tax fraud, lying under the penalties of perjury, production of false or fabricated documents, and whatever other civil penalties and criminal charges they see fit which will land you in prison aside from the six figures penalties.

Incompetent 501c3 applicants & day dreamers are 1023-EZ candidates

The day dreamers will benefit greatly from this form as it takes a mere 20 minutes to go from idea to full tax exemption. The fact that they will fail within the first few months and will lose the $275 application fee is trivial. Many of the applicants who choose to use the Form 1023EZ are literally illiterate folks who are incapable of writing a Narrative Description of Activities for the real Form 1023.

These are the organizations that don’t have a clue what they’re going to do, how much money they need, and what actual purpose they’re going to serve. Narrative Description of activity is basically the business plan of the nonprofit and by not having any plans, they are just hoping that everything magically will fall in place. How do I know? They call me all day long. Thanks to the IRS, I won’t have to deal with this bunch any more.

Nonprofit organizations that do NOT qualify for the form 1023 EZ

Beside the $50,000 revenue cap and $250,000 assets limitation which I mentioned at the start of this article, the following types of nonprofits do NOT QUALIFY to apply for tax exemption using the form 1023 EZ as well:

- Nonprofits that were formed under the laws of a foreign country or have their mailing address outside the united states

- Nonprofits that are not corporations such as an LLC

- Organizations that are formed as a for-profit entity

- Nonprofits who have had a tax exemption and their exemption was revoked

- Churches and association of churches

- Schools colleges and universities of any kind

- Hospital or medical research organization

- Agricultural research organization

- Cooperative hospital service organization

- Cooperative service organizations

- Charitable risk pool organizations

- Supporting organization

- Organizations that provide credit counseling activities such as budgeting, personal finance, financial literacy, mortgage foreclosure assistance, or other consumer credit

- Nonprofits that have or will invest 5% or more of your total assets in securities or funds that are not publicly traded

- Environmental nonprofits that sell, or intend to sell carbon credits or carbon offsets

- Health Maintenance Organizations (HMOs)

- Accountable Care Organization (ACO), or an organization that engages in, or intends to engage in, ACO activities (such as participation in the Medicare Shared Savings Program.

- Organizations that do or intend to maintain one or more donor advised funds

- Nonprofits that are organized and operated exclusively for testing for public safety

- All private operating foundations

Form 1023 EZ frequently asked questions

How long does it take for form 1023 EZ to be approved?Generally form 1023 EZ takes about 30 days and can take up to 2 months to be approved by the IRS if there are no questioning. Form 1023 EZ has a somewhat faster processing time as opposed to the long 501c3 application form.

Can we file the form 1023 EZ and then later use the 1023 long version?Absolutely not. You cannot use the form 1023 EZ to apply for tax exemption and then file the long 1023 form later. You only get one shot and it can never be changed. I get this question from nonprofits trying to beat the system but it doesn’t work that way. You have to remember that you’re signing an affidavit under penalty of perjury, meaning that you can end up in jail for 5 years and be fined $250,000. If you’re hell-bent on doing it, take your shot and let me know how it goes.

How much does it cost to file form 1023 EZ?The IRS form 1023 EZ application fee is $275

What are the difference between form 1023 and 1023 EZ?I’ve explained the differences between the form 1023 EZ and the long form above, but the major difference is the limitation on the revenue that the potentially exempt organization can receive.

Where can I find the form 1023 EZ eligibility worksheet?You can find the Form 1023 EZ eligibility worksheet from here.

Conclusion

I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal rescue organizations and alike that don’t need big funds. If you are not feeding stray dogs and cats in streets, look the other way and use the long version of the Form 1023. Don’t use the Streamlined Application for Tax Exemption, you will regret it big time sooner than later.

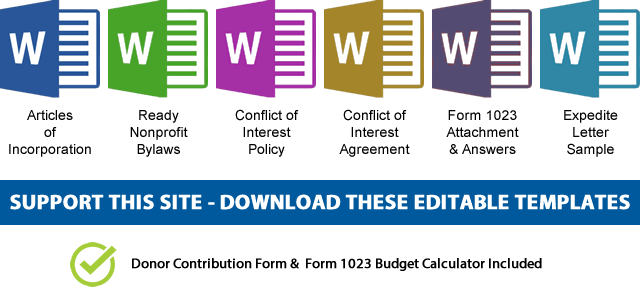

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.