When it comes to nonprofit executive salaries and compensation, nonprofit organizations have become every bit as greedy as the for-profit sector, and in some cases, it has surpassed the latter. In today’s market, the administrative cost, nonprofit CEO salaries, and nonprofit executive compensations has become a direct derivative of the organization’s net income. The more the organization receives, the higher the salary of its CEO and executives will be. A 10 million dollar nonprofit corporation will have a surplus of 1.5 to 3 million dollars to candy out to its executives and other expenditures.

How much can you pay your nonprofit CEO?

As in the for-profit companies and specially the financial sector, the nonprofit tax laws have been hacked to pieces to ensure that top charity CEOs can enjoy their seven-figure pay, private jets and multi-million dollars homes in the Caribbean. The IRS has a laughable term describing fair nonprofit organizations executive compensation which gives the green light to this shameful money sacking: “Reasonable Compensation.”

The IRS Reasonable Compensation definition for nonprofit Organizations

The IRS Reasonable Compensation is defined as “the value that would ordinarily be paid for like services by like enterprises [for-profit] under like circumstances.”

Going by this vague pay standard, the 2.5 million dollar CEO salary of William Barram of the American Cancer Society, or the 1 Million dollar CEO salary of Gail McGovern of the American Red Cross is rightly justified as a reasonable compensation, because the net income of their respective tax exempt nonprofits is comparable with the for-profit enterprises of their class.

And when charity watchdog groups disclose these pay numbers with the public and a few souls raise their concerns, the kind of Miss Betsy Brill, publish defensive articles in nation’s economic papers like Forbes to tone down the criticisms. In her article for Forbes Magazine, titled “Nonprofit CEOs Are Worth Every Dime”, Miss Brill goes on and on to why these nonprofit thieves are entitled to public donations that were intended for a charitable purpose rather than buying another Rolls-Royce:

“…critics may cause donors to question–or even to pull back–their charitable giving at a time when nonprofits are struggling to meet an increased demand for services in the face of government cutbacks and dwindling private support.”

What did she just say? “At a time when nonprofits are struggling?” Miss Brill never explains why the “struggling nonprofit organization” board is paying it’s CEO a seven figure salary if it is indeed struggling. But she is quick to add: “Keep in mind that the highest paid CEOs are overseeing complex multi million dollar ventures.” Does she have alternative motives? You bet.

Compensation of the nonprofit criminal executives

For many years prior to the market collapse of 2008, over-fed, over-paid, white-color financial analysts told us the very same thing, “AIG is doing wonderful, Lehman Brothers is at the top of its game. Don’t fear, invest, buy this, give them your money…” And when the economy collapsed and 700 billion dollars came out of the taxpayers’ pockets to bail out these criminals, these very same analysts justified their deceptiveness by saying that what they said was “just an opinion”.

They got paid to put AAA ratings on worthless Collateralized Debt Obligations (CDO) and investors bought these high risk worthless junks because credit rating agency’s like Moody’s and Fitch endorsed them and backed out later. Miss Brill doesn’t work for a Credit Rating Agency, she owns a counterpart of it in the nonprofit sector. She is the President of Strategic Philanthropy, Ltd., a philanthropic advisory firm in Chicago. Same shit, different name.

Tax exempt nonprofit organizations or a charity is no different from a for-profit entity. Where there is money, there will always be greed. Where there is money, there will be also power, and mankind is prone to abuse both. In for-profit corporations, the share holders and investors question the executives on how their money is being spent, but in nonprofits, the faith of the donors are in hands of it’s board, a few volunteers, and more often than not, the organization’s CEO holds a dictatorial power over the governing body and the board of directors.

It is irrelevant that the board has the power to hire and fire the CEO, the CEO in a nonprofit organization is nevertheless the dictator and the law maker of the organization with only the IRS to answer to. And the IRS position is already clear: “Reasonable Compensation.” What the hell ever that means.

Nonprofit excessive compensations

The only difference is that when a for-profit corporation goes bankrupt, shareholders and investors lose money and their outcry makes the evening news, but when a tax exempt nonprofit organization goes under, there is no one to take the hit, not even it’s board. Donors give less than a damn – hey, they gave the money away in the first place – and in most cases they don’t even want to know where their money goes as long as the organization has a picture of a skinny black baby or a woman with one breast cutoff on the header of their website.

The real victims of this criminal racket are the poor, the class that was supposed to be served, but they have no voice. Their voice, if any, gets lost in the roar of the private jet engines and sport cars of the executives who stole their money in the name of making a difference.

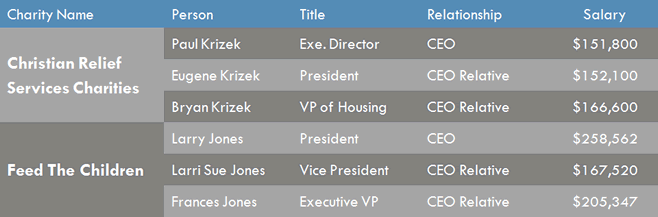

We are being told on an alarmingly increasing rate, that being a charity and nonprofit doesn’t mean not making a profit. More and more tax exempt nonprofits and charities are running mafia-style businesses as they hire and compensate their own relatives as CEO, CFO,.. inside the organization with many six figure incomes. Then the seven figure elite supporters come in and tell us that only those making these ungodly sums have the intellect and capability to pull off the operations in these large entities. But, long ago, before there were these excessive executive salaries, nonprofits did just that and the poor received the majority. Imagine that.

Why is excessive nonprofit executive compensation an issue?

It’s not the legality of these gruesome tax exempt executive compensations that is the issue; it’s the morality and deception of the whole business. Assuming that you’re not corrupt – you form a nonprofit organization because you are compelled to help people and naturally surround yourself with those who have the same inkling. Do you have the power to abuse them? Absolutely. But at the end of the day you know, what you take is what could’ve put a smile on a poor child’s face.

To me and many others, that’s the drive not the pay and salary.

I leave you with one question: is the job of managing a tax exempt charity really more “complex” than running a 300 million plus population country? If not, how do you justify executive compensation and salaries as large as six times of the United States President? Don’t we have any talented people willing to manage charities in the same unselfish spirit as their donors? If not, we should outsource these jobs to China too, they sure as hell will do a better job of it for a much lower pay.

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.