Can you file the IRS form 1023 yourself?

Yes You Can, and you should complete the form 1023 yourself. This nonprofit help website is a complete and free source of information and form 1023 instructions for starting a tax-exempt charitable nonprofit organizations including Private Foundations by preparing your own 501c3 application, the IRS form 1023 (Application for Recognition of Tax-Exemption under section 501c3 of the Internal revenue code).

This site also has the most in-depth set of articles and instructions on starting a 501c3 church or a religious ministry.

The new and improved online IRS form 1023 application for tax-exemption is explained and examined page by page, section by section and every question is answered with information and references to successful 501c3 nonprofit applications, sample documents, and complete IRS Form 1023 instructions to file on pay.gov to receive your tax-exempt status.

How much does it cost to start a Nonprofit 501c3 Organization?

How much does it cost to start a nonprofit 501c3 is the main question I’m asked on a daily basis. The simple answer is that it costs less than $700 if you do all the work yourself. The form 1023 (long version) application fee is $600 and if you do qualify for the form 1023-EZ (I don’t recommend it), the application fee would be $275. Incorporation cost is around $50 and that’s all the fees you would have to pay to the federal and State agencies. Budget for a few Advils and you can start with your 501c3 application and fundraising.

On this site I start from the very beginning of the form 1023 with instructions on how to apply, file, and form a 501c3 nonprofit organization, by preparing the

- Nonprofit Articles of Incorporation for state incorporation,

- Nonprofit Bylaws to stay IRS compliant,

- Nonprofit Conflict of Interest Policy so you don’t lose your exemption status,

and explore the more advanced nonprofit topics and information such as Private Foundations, Private Operating Foundations, directors salaries, and international and foreign activities.

This site also deals with the topic of Retroactive Reinstatement of Nonprofit 501c3 Tax Exemption Status.

Who this 501c3 Tax Exemption Application help website is for:

These resources are for nonprofits who are applying or starting a 501c3 nonprofit organizations to truly help others, and their nonprofit mission complies with the IRS exemption definition:

Solely for charitable, religious, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition, or for the prevention of cruelty to children or animals within the means of section 501c3 of the Internal Revenue Code.

- All Public Charities. This is the most recognized type of 501c3 exempt organization.

- Private Foundations. Please see starting a private foundation to make sure that’s what you want, if it is, just follow the form 1023 instructions. Most who think they are private foundations are actually public charities so read through this website and pay attention to clarifications. You can still use this site for 100% of all the information as they hold true for Private Foundations.

- Private Operating Foundations. Same as above, read the private foundation vs. public charities explanation.

Who this 501c3 Application website is potentially NOT for:

- Nonprofit organizations formed solely to support another specific organization. (Contact me if you fall under this category)

- For-profit entities wanting to become a nonprofit and file the Form 1023 application. (In my experience, 99% of this group want to avoid paying taxes with no real intention of doing good.) Please read the Successor Organizations definition and explanations.

- Large Medical organization i.e. hospitals, clinics, wellness centers who want to file for recognition of tax-exemption. (This group should seek professional assistance for their application. Contact me if you fall under this category for nonprofits)

- Insurance providing entities who want to file for recognition of tax-exemption under the section 501c3 of the Internal Revenue Code. (This group should seek professional tax assistance for their application.)

Preparing and filing the form 1023 (501c3 application) is not a walk in the park, No matter whether it’s a private foundation or a public charity. But as this site has demonstrated time and time throughout the years, your organization can successfully apply and become 501c3 tax exempt as have thousands of other organizations by filling the IRS Form 1023 yourself using my instructions.

The benefits of applying yourself outweighs the hardship, as it rewards you financially and in lessons learned that can be applied to the success and future of your non-profit.

Frequently asked questions about the form 1023

How long does it take for the form 1023 to be approved?

Form 1023 or also known as 501c3 application can take up to 2 years to be approved or denied but if the application was done correctly it normally takes about 3 months. The point of this website is to help you avoid common mistakes and get your exemption status as fast as possible. If you follow my form 1023 instructions without skipping pages, I promise you that you won’t have to wait for long. Just look at the testimonial page and find out for yourself.

What is the short version of the form 1023?

The streamlined application for tax exemption or form 1023 EZ is a federal tax exemption 501c3 application that “tries” to make the exemption process easier. However it has several problems and severe limitations which makes it impractical for most nonprofits. I’ve covered this subject in detail on this website.

What is the difference between nonprofit and tax-exempt status?

Nonprofit status is a state designation. Nonprofit status may make an organization eligible for certain state benefits, such as state sales, property and state income tax exemptions. Although most federal tax-exempt organizations are nonprofit organizations, organizing as a nonprofit organization at the state level does not automatically grant the organization exemption from federal income tax.

Can we file the form 1023 if it has been 27 months since our organization was formed?

In general, a nonprofits must file their exemption application using the form 1023 within 27 months from the end of the month in which they were formed. If they do file within the 27 months, they may be recognized as tax-exempt back to the date of their incorporation. If an organization files its tax-exemption application after the 27-month deadline, exempt status may only be recognized from their filing date.

Can you file the form 1023 if the organization was formed outside of the United States?

Yes and no. A foreign organization may qualify for exemption under section 501c3 even if it was formed outside the USA or conducts its activities in a country other than the United States. However, donations to organizations formed in a foreign country are generally not tax deductible as charitable contributions. Exceptions are made for countries that have a treaty with the United States on this matter.

For example, contributions to Canadian charities may be deductible, while contributions to charities based in most other countries are not.

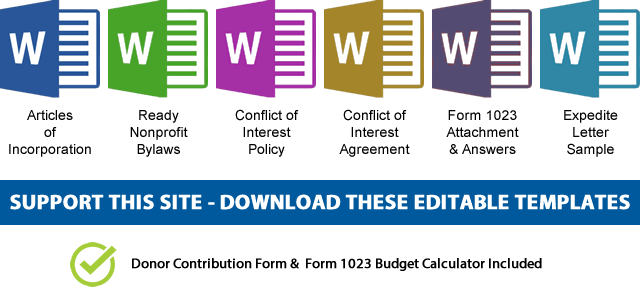

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.