Does a church need a nonprofit 501c3 status?

The short answer and maybe the correct answer is No. There’s no good reason to apply for 501c3 tax exemption for a church as many will claim. And depends on how you look at it, it’s very true. Churches are automatically exempt from taxation, period. However, ministries and other religious organizations are not!

The short answer and maybe the correct answer is No. There’s no good reason to apply for 501c3 tax exemption for a church as many will claim. And depends on how you look at it, it’s very true. Churches are automatically exempt from taxation, period. However, ministries and other religious organizations are not!

If you’re wondering how to start a church, a 501c3 ministry, or even taking it one step further by starting a 501c3 church with exemption letter from the IRS, you should read all the church articles on this site top to bottom, as these instructions apply to all churches and religious organizations, automatically exempt or otherwise.

I very much doubt the Pope is reading this article to find out how the Catholic Church can apply for 501c3 tax exemption letter. To the contrary, I think the reader of this article is most likely an honest man, trying to do the right thing in spite of the status quo.

It’s imperative to mention that the word church for the sake of tax exemption is not a reference to the Christian Church of any denomination, it encompasses any recognized place of worship including synagogues, mosques, and temples. It’s just a collective term in this context.

Should you apply for 501c3 tax exemption for a church? Are there any benefits?

When people think about starting a church, they usually don’t think of the legal ramification. To tell you the truth, your church will generally be exempt from paying some federal taxes whether you apply for 501c3 status or not. On the other hand, it is a myth that applying for 501c3 status puts undue burden of any kind on your church. Under the law, churches with 501c3 exemption letter and without are all dealt with equally.

By applying for 501c3 tax exemption status for your church, you have nothing to lose and much to gain. There are many benefits that a 501c3 recognized church can receive such as:

- Eligibility for many grants that otherwise you couldn’t apply for. A lot of foundations look for an excuse to not give their grants to churches by requiring exemption letter! Right or wrong, it’s the way it is.

- Eligibility to receive donations in form of wholesome excess food and food items from restaurants, grocery stores, and supermarkets alike by eliminating the donor’s liability under Bill Emerson Good Samaritan Food Donation Act of 1996. This is only applicable to churches that are exempt under 501c3 section of the internal revenue code by application, not by automatic exemption.

- Major nonprofit discounts at many wholesalers, stores, and companies. Almost all companies require documentation showing that your church has a 501c3 tax exemption letter.

- Exemption from paying sales tax from other states which do require 501c3 tax exemption letter.

And business benefits aside, It all comes down to honesty. The most important thing is the message that you send to your congregation by the manner that you form and start your church: Our Church is not part of the corrupt and secretive non-transparent status quo.

501c3 tax exemption for churches comes with transparency

There are two kinds of people in this world, honest people and dishonest people. A church or religious organizations run by human beings are no different.

- If I were to consider myself a Christian, by definition, I would have to adhere to some serious Jesus-like values such as honesty, transparency, compassion for those in need, treating others as one would like to be treated, being modest, respectful, and non-violent among other things. If I were thinking about starting a church, naturally I would have to apply all the above to the place that would be the home of god.

More and more churches are distancing themselves from the long running non-transparency policy because they’re simply sick of hearing that all churches are in the business of embezzling public funds, raping altar boys, polygamy, and tax evasion. We’re not talking about transparency to the government, but transparency to the congregation and the general public. You’re not asking the IRS for approval, you’re telling the public that you have nothing to hide.

I know of many honest and god-fearing pastors who are just fed up with everything because of the conduct of the money grubbing conglomerate churches who’ve forgotten what it’s like to follow in the footsteps of Jesus Christ. It’s entirely up to you, the image that you want to portray of your church and your true convictions.

What is considered a church? What are the qualification?

Before starting a church, whether 501c3 or not, you have to know that not all religious organizations are considered churches. Because special tax rules apply to churches, it’s important to distinguish churches from other religious organizations. Therefore, when I use the term “religious organizations,” it isn’t referring to churches or integrated auxiliaries.

Religious organizations that are not churches typically include nondenominational ministries, interdenominational and ecumenical organizations, and other entities whose principal purpose is the study or advancement of religion.

Churches and religious organizations may be legally organized in a variety of ways under state law, such as unincorporated associations, nonprofit corporations, and charitable trusts. If you’re applying for 501c3, then it should be a nonprofit corporation.

To be qualified and be exempted from paying taxes as a church, you would have to have some characteristics such as:

- church should have a distinct legal existence;

- a church with recognized creed and form of worship;

- church should have a definite and distinct ecclesiastical government;

- formal code of doctrine and discipline;

- distinct religious history (you can’t be a church if you just invented your religion);

- membership not associated with any other church or denomination;

- organization of ordained ministers;

- ordained ministers selected after completing prescribed courses of study;

- literature of its own;

- established places of worship (the actual location of the church);

- regular congregations;

- regular religious services (it can’t be on and off);

- Sunday schools for the religious instruction of the young; and

- schools for the preparation of its ministers.

The IRS generally uses a combination of these characteristics, together with other facts and circumstances, to determine whether a nonprofit organization is considered a church for federal tax purposes.

It’s important to know that the IRS doesn’t evaluate the content of whatever doctrine a particular organization claims is religious, as long as the beliefs of the organization are truly and sincerely held by those professing them and the practices and rites associated with the organization’s belief or creed are not illegal or contrary to clearly defined public policy.

what is an Integrated Auxiliary of a Church?

Beside ministries and churches, there are also organizations that are considered integrated auxiliary of a church. The term integrated auxiliary of a church refers to a class of organizations that are related to a church or convention or association of churches, but are not necessarily churches themselves. In general, the IRS will treat an organization that meets the following three requirements as an integrated auxiliary of a church.

These types of organizations must:

- be described both as an IRC (internal Revenue Code) Section 501c3 charitable organization and as a public charity under IRC Sections 509(a)(1), (2) or (3);

- be affiliated with a church or convention or association of churches; and

- receive financial support primarily from internal church sources as opposed to public or governmental sources.

Men’s and women’s organizations, seminaries, mission societies and youth groups that satisfy the first two requirements above are considered integrated auxiliaries whether or not they meet the internal support requirements. More guidance as to the types of organizations the IRS will treat as integrated auxiliaries can be found in the Code of Regulations, 26 CFR Section 1.6033-2(h).

This is where the 501c3 exemption letter comes in handy because you can apply for a grant not for the church itself, but for its auxiliary program such as youth and children development.

The same rules that apply to a church apply to the integrated auxiliary of a church, with the exception of those rules that apply to the audit of a church, meaning that an organization that is an integrated auxiliary of a church doesn’t enjoy the semi-immunity from the IRS audits as churches do.

Starting a church with 501c3 tax-exempt status

Further above, I talked about the automatic tax exemption so let’s dig in deeper on what’s required for starting a 501c3 church and how to file a church 501c3 application.

Starting a Church with tax exemption under the umbrella of a Central or Parent Organization

A church with a parent organization may wish to contact the parent entity to see if it has a group ruling. If the main church holds a group ruling, then the IRS may already recognize the church as tax exempt. Under the group exemption process, the parent organization becomes the holder of a group ruling that identifies other affiliated churches or other affiliated organizations. A church is recognized as tax exempt if it is included in a list provided by the parent organization. If the church or other affiliated organization is included on the list, it doesn’t need to take further action to obtain recognition of tax-exempt status.

An organization that isn’t covered under a group ruling should contact its parent organization to see if it’s eligible to be included in the parent’s application for the group ruling.

Religious Organizations that are not churches

Unlike churches, religious organizations that wish to be tax exempt must apply to the IRS for tax-exempt status unless their gross receipts do not normally exceed $5,000 annually.

How to apply for Church 501c3 tax-exempt status

The process of applying for church or ministry 501c3 exemption through 501c3 application (Form 1023) is covered in detail throughout this website and it’s exactly the same as any other nonprofit. However, churches and religious organizations have somewhat different compliance requirements which I’ve detailed in the following articles that specifically apply to religious entities:

- Church Charitable Contributions and Donations Regulations & Laws

- Church Ministers Compensation and Salaries Laws & Regulations

- Churches and Unrelated Business Income TAX

- Churches Political Activities and its consequences

- When a Church or Ministry Gets Audited by the IRS

Churches are also required to complete the Form 1023 Schedule A.

Employer Identification Number (EIN) for Churches

Every tax-exempt organization, including a church, should have an employer identification number whether or not the organization has any employees. There are many instances in which an EIN is necessary. For example, a church needs an EIN when it opens a bank account, to be listed as a subordinate in a group ruling or if it files returns with the IRS (for example, Forms W-2, 1099, 990-T).

An organization may apply for an EIN by filing Form SS-4, Application for Employer Identification Number, according to its instructions. If the organization is submitting IRS Form 1023, Application for Recognition of Exemption Under Section 501c3 of the Internal Revenue Code, the EIN should be listed on the form.

501c3 Application Form 1023 for Churches

When applying for recognition as tax exempt under IRC Section 501c3, churches and some religious organizations must use the form 1023. Smaller religious organizations may be eligible to use Form 1023-EZ, Streamlined Application for Recognition of Exemption. However I do not recommend it. A church applying for 501c3 exemption cannot use the form 1023 EZ.

A religious organization generally must submit its application within 27 months from the end of the month in which the organization is formed to be considered tax exempt and qualified to receive deductible contributions as of the date the organization was formed. On the other hand, a church may obtain recognition of exemption from the date of its formation as a church, even though that date may be prior to 27 months from the end of the month in which its application is submitted.

This means that your church doesn’t have to be a new church, it can be a 100 year old church and you can still apply without worrying about anything. No other types of organizations are afforded this flexibility.

The cost of applying for church 501c3 tax exemption is exactly the same as any other nonprofit organization. The IRS is required by law to collect a non-refundable form 1023 user fee from any organization seeking a determination of tax-exempt status under IRC Section 501c3.

Church 501c3 tax exemption Status and how you can lose it

All Section 5013 organizations, including churches and religious organizations, must abide by certain rules. Contrary to misinformation campaign of corrupt church leaders, these rules DO APPLY to churches that are considered exempt automatically as well. :

Churches and religious organizations, like many other charitable organizations, qualify for exemption from federal income tax under Internal revenue code section 501(c)(3) and are generally eligible to receive tax-deductible contributions. To qualify for tax-exempt status, a church or a religious organization must meet the following requirements (covered in detail throughout this website):

- the church or the ministry must be organized and operated exclusively for religious, educational, scientific or other charitable purposes;

- net earnings of church or the ministry may not inure to the benefit of any private individual or shareholder;

- no substantial part of the church or the ministry’s activity may be attempting to influence legislation;

- the church or the ministry may not intervene in political campaigns; and

- the church or the ministry’s purposes and activities may not be illegal or violate fundamental public policy.

Inurement and Private Benefit of Churches

Inurement to Insiders – Churches and religious organizations, like all exempt organizations under section 501c3, are prohibited from engaging in activities that result in inurement of the church’s or organization’s income or assets to insiders (such as persons having a personal and private interest in the activities of the organization). Insiders could include the minister, church board members, officers, and in certain circumstances, employees.

Examples of prohibited inurement include:

- the payment of dividends,

- the payment of unreasonable compensation to insiders

- and transferring property to insiders for less than fair market value.

The prohibition against inurement to insiders is absolute; therefore, any amount of inurement is, potentially, grounds for loss of tax-exempt status. In addition, the insider involved may be subject to excise tax. See the following section on Excess benefit transactions. Note that prohibited inurement doesn’t include reasonable payments for services rendered, payments that further tax-exempt purposes or payments made for the fair market value of real or personal property.

Excess benefit transactions. In cases where a section 501c3 organization provides an excess economic benefit to an insider, both the organization and the insider have engaged in an excess benefit transaction. The IRS may impose an excise tax on any insider who improperly benefits from an excess benefit transaction, as well as on organization managers who participate in the transaction knowing that it’s improper. An insider who benefits from an excess benefit transaction must return the excess benefits to the organization. Detailed rules on excess benefit transactions are contained in the Code of Federal Regulations, Title 26, sections 53.4958-0 through 53.4958-8.

Church Private Benefit – A section 501c3 organization’s activities must be directed exclusively toward charitable, educational, religious or other exempt purposes. The organization’s activities may not serve the private interests of any individual or organization. Rather, beneficiaries of an organization’s activities must be recognized objects of charity (such as the poor or the distressed) or the community at large (for example, through the conduct of religious services or the promotion of religion).

Private benefit is different from inurement to insiders. Private benefit may occur even if the persons benefited are not insiders. Also, private benefit must be substantial to jeopardize tax-exempt status. Please read the following for further information on what jeopardizes the tax exemption status of a nonprofit organization.

Record keeping Requirements for Churches

All tax-exempt organizations, including churches and religious organizations (regardless of whether tax-exempt status has been officially recognized by the IRS), are required to maintain books of accounting and other records necessary to justify their claim for exemption in the event of an audit. See Special Rules Limiting IRS Authority to Audit a Church. Tax-exempt organizations are also required to maintain books and records that are necessary to accurately file any federal tax and information returns that may be required.

There is no specific format for keeping records. However, the types of required records frequently include organizing documents (charter, constitution, articles of incorporation) and bylaws, minute books, property records, general ledgers, receipts and disbursements journals, payroll records, banking records and invoices. The extent of the records necessary generally varies according to the type, size and complexity of the religious organization’s activities. Please read the following for further information on 501c3 record keeping and accounting requirements.

Form 990 requirements for churches and religious organizations

Generally, all religious organizations must file Form 990, Form 990-EZ or Form 990-N except churches and the following related organizations:

- Inter-church organizations of local units of a church,

- Mission societies sponsored by or affiliated with one or more churches or church denomination, if more than half of the activities are conducted in or directed at, persons in foreign countries,

- An exclusively religious activity of any religious order

Please read the following for further information on who must file the form 990 information return.

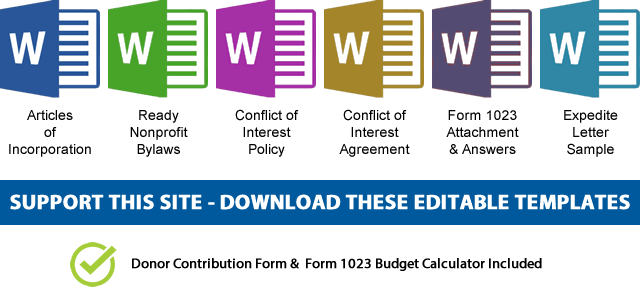

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.