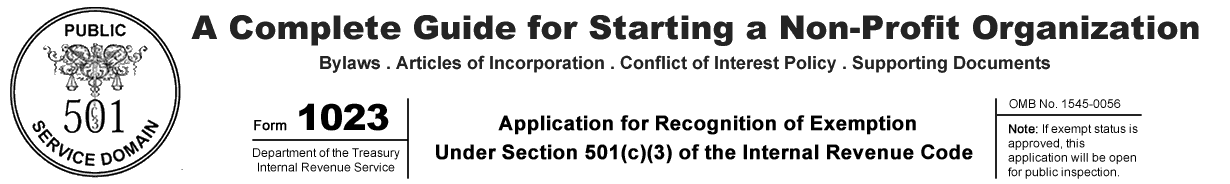

This directory covers the first half of the IRS Form 1023 schedules from A through D, used for specialized entities such as churches, schools, hospitals, and supporting organizations. Each article decodes what the IRS actually wants and how to prove your eligibility without writing a novel.

Most straight forward small nonprofit organizations applying for tax exemption usually don't need to fill out any form 1023 schedules, however if the Form 1023 redirects you to one, it means it is required and has to be answered.

Schedule A. Churches

Schedule A of the Form 1023 is only for churches. These are the instructions on how to answer the questions on the Form 1023 Schedule A.

Schedule B. Schools & Universities

Instructions on how to answer the questions on the Form 1023 Schedule B for Private Schools, Colleges & Universities applying for tax exemption.

Schedule C. Hospitals & Medical Orgs

Complete Instructions for the Schedule C of the Form 1023 is for hospitals, medical research organizations & Cooperative hospital service organizations.

Schedule D. Supporting Organizations

Schedule D of the Form 1023 is for supporting organizations. These are the instructions on how to answer the questions on the Form 1023 Schedule D.