Starting a 501c3 Nonprofit Organization for dummies Ultimate how-to guide!

Starting a 501(c)(3) nonprofit organization may sound intimidating, but with patience, honest advice, practical legal guidance, and the right tools, you can successfully launch your nonprofit — just like thousands who’ve used the free resources on this site.

Starting a 501(c)(3) nonprofit organization may sound intimidating, but with patience, honest advice, practical legal guidance, and the right tools, you can successfully launch your nonprofit — just like thousands who’ve used the free resources on this site.

This comprehensive 501c3 startup guide walks you through the basics and practical steps: IRS designations, required forms, tax-exempt status, and, most importantly, how to stay compliant with IRS rules – so your nonprofit doesn’t get shut down in its first year.

At the bottom, you’ll find state-specific requirements for places like California, Texas, Florida, and New York. But first, we’ll cover the federal basics that apply across all states.

Be mindful of misinformation regarding tax exemption status process

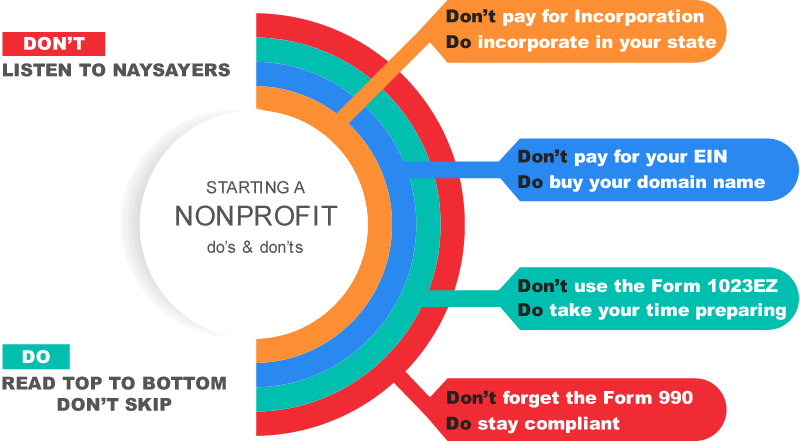

There is a lot of misinformation regarding this legal process and most of them are sadly the top results of search engines. Read this guide and resources carefully as this is arguably the only honest article on starting a 501c3 nonprofit in the bunch that wasn’t put up for marketing or advertisement. Here you truly learn how to start a 501c3 nonprofit organization from writing your nonprofit mission statement to filing your federal application for 501c3 tax exemption status.

There are 7 steps to start & form a 501c3 nonprofit organization:

- Planning, writing a Mission Statement, and doing a State Business Name Search.

- Filing the Nonprofit Articles of Incorporation, Don’t use incorporation services.

- Assembling the Board of Directors and conducting the first board meeting.

- Creating the Nonprofit Bylaws. Bylaws are required by the IRS for filing your 501c3 application.

- Creating the Nonprofit Conflict of Interest Policy. CIP is required by the IRS for tax exemption.

- Applying for the Employer Identification Number (EIN). EIN is FREE, do not pay for it.

- Preparing your form 1023 application for 501c3 tax exemption online on pay.gov. Step by step form 1023 instructions are provided here.

All these 7 steps are painstakingly explained in detail on this page as you go down, but you can’t start a 501c3 nonprofit without knowing which kind you should start to begin with. So let’s understand the types, pros and cons and qualifications for each type.

What is a 501c3 Tax Exempt Organization & which type to start?

Tax-exempt organization is a broad term used to encompass many different categories of nonprofits which are exempt from paying federal taxes fully or to some extent.

Nonprofit Corporation is a state designation whereas 501c3 exemption status is a Federal Tax-Exemption status. Not all nonprofit corporations are 501c3 exempt, and not all 501c3 exempt organizations are nonprofit corporations.

When a nonprofit corporation applies for and receives 501(c)(3) tax-exempt status from the IRS, it becomes exempt from paying federal income tax on eligible revenue. Even more importantly, donations made to the organization are tax deductible for the donor.

Pay close attention to the term “tax exemption.” It means the organization itself is exempt from paying federal taxes, but that doesn’t automatically make donations to it tax deductible for donors. This distinction is crucial: if you start the wrong kind of nonprofit, you could end up with an entity that struggles to attract donors because their contributions won’t be tax deductible.

The most recognizable types of nonprofits are 501(c)(3) charitable organizations that fall under section 501 of the Internal Revenue Code. However the activities which these public organizations perform dictate the tax-exempt classification by the IRS.

The major classifications of tax exempt nonprofits are:

- Charitable Organizations

- Social Welfare Organization

- Agricultural or Horticultural Organization

- Labor Organization

- Business League (Trade Association)

- Social Clubs

- Fraternal Societies

- Employee Benefit Associations or Funds

- Veterans’ Organizations

- Political Organizations

- Other types of exempt Organizations

Public Charity or Private Foundation ?

Now you may have heard of a Private Foundation or in some cases a Private Operating Foundation. These two types of tax exempt organizations are very different from public charities in their operations and their tax exemption status. Public charities are not foundations – they rely on broad public support or run specific public programs. Private foundations, on the other hand, are usually funded by a single source and face more restrictions.

Should you start a Private Foundation?

To put it simply: Private Foundation status is for the wealthy. Public charity status under 501(c)(3) is for everyone else.

Private foundations are created by individuals or entities that don’t rely on public donations for funding. They don’t have to fundraise because their money comes from a small group of sources. If you don’t have deep pockets, a private foundation is the wrong choice.

Take the Bill & Melinda Gates Foundation – the Microsoft billionaires don’t need your $5 donations. They can fund their foundation several lifetimes over. If they do fundraise, it’s usually from other billionaires who can write checks equivalent to the GDP of Ethiopia.

- More technically, a private foundation is a tax-exempt nonprofit that doesn’t qualify as a public charity. It’s funded from a limited pool, invests its funds to sustain itself, and primarily makes grants or contributions for charitable purposes.

The downside? Private foundations face strict IRS regulations, less favorable donor tax deductions, and near-total bans on lobbying.

I’ve written an in-depth article on How to Start a Private Foundation in case you’re interested.

Should you start a 501c3 Public Charity?

Public charities are the most common type of tax-exempt 501(c)(3) nonprofit — and for good reason. They’re truly “public” organizations, supported by broad fundraising efforts and donations from the general public. Donations to public charities are tax deductible, which makes them the most attractive nonprofit type for donors, corporations, and grantmakers.

Because of this, public charity status is the most sought-after classification for tax-exempt nonprofits. No corporation or grantmaker wants to donate if they can’t get a tax write-off.

Examples of public charities include churches, aid organizations, schools, hospitals, and animal rescue groups. This guide focuses primarily on public charities, though many of the federal application steps are similar for other 501(c)(3) types—including private foundations.

Starting a 501c3 Church or Ministry

If you’re staring a church or a religious ministry, along with this guide you should also read the Church 501c3 Exemption Application & Religious Ministries section as it breaks down the church and religious specific issues and laws. However the process is exactly the same as starting any other 501c3 nonprofit organization.

Before starting to form a 501c3 nonprofit organization or filing the IRS Form 1023, or even thinking about the mission statement, you need to ask yourself two simple questions:

Are there any other nonprofit 501c3 organizations doing the same thing?

There are over a million charitable nonprofits in the United States alone promoting and fighting one cause or another so chances are that your cause is already covered by 100 other likewise nonprofits. You need to be honest with yourself; are you really going to do a better job? Do you have the resources? Can you get the funding? Do you have the drive? Can you get help from your peers? Can you find the time? Can you benefit the public?

Nine out of ten cases, you’ll find that you should just support existing charitable organizations instead of forming a new one because in reality, the more diverted the efforts and resources get the results for the public suffer respectively. You may also find that for some very specific short term projects, it might not be a bad idea to use a Nonprofit Fiscal Sponsor for the purpose of tax exemption. It’s always best to write a nonprofit business plan, weigh all your options and then proceed.

Should you even start a 501c3 nonprofit organization?

The process of running nonprofits and going on a blind-date is not all that different – It’s scary and requires a lot of getting used to. Nonprofits are just like other businesses; the only difference is that you make profit for the benefit of the public rather than making yourself rich. Knowing all that, starting a 501c3 nonprofit corporation is thousand times harder than a for-profit business, because your hands and resources will be tied by the federal laws on what you can or cannot do by the IRS.

Sometimes it’s better to pay taxes, and be free in your business programs than holding a 501c3 nonprofit status and not being able to do what you wanted in the first place. Organizing profitable nonprofits is hard, but not impossible with a little help, getting to know the federal law, and patience.

Another thing that you need to know is that the Internal Revenue Code has many sections. Section 501 is only one section, and the 501(c)(3) refers to a single article under this section. Just because you are a nonprofit corporation, that doesn’t mean that you qualify under this section, and at the same time you might qualify for tax exemption under another section but not 501c3.

There are 27 other chapters that will grant your nonprofit a tax-exemption status but are not charitable. If you settle down on section 501c3, the next step is to take the Public Charity Test and see if you actually possess the qualifications to even apply under the section 501(c)(3) for tax exemption status. If you do pass the charity test, then rest of your work is cut out for you.

Assuming that you’re still interested and haven’t closed this page, let’s plan your future, your hard work start from here, buckle up, it’s gonna be a long ride:

Start a Nonprofit Step 1: Business Name Search, Mission Statement & Registration

Business Name Search for Nonprofits

To start a 501c3 nonprofit, before anything else, you need to decide on what you’re going to call you organization. The nonprofit name is important for several reasons and if you pick a name out of the hat, you’ll probably regret it sooner than later. If you ever need to change the name of the nonprofit organization after you’ve received your determination letter from the IRS, you’ll be in a world of pain and plan on having a deep pocket.

The business name search is done on your Secretary of State website. Some States charge a small fee to reserve the name and some don’t. Usually as soon as you register the nonprofit name with the state, you should buy your domain name as well.

You need to consider two factors before you choose your nonprofit name:

- Are there any other organizations with the same or similar name? Stay away from similar sounding names as you’ll be hard pressed to find a good domain name for your nonprofit organization’s website, not mentioning getting sued by other businesses for trademark infringement.

- Is the website domain name available for your chosen name? You should check whether the domain name is available before anything else, and not just any domain name, you need to get the .org TLD along with other TLDs such as .com and .net. Just make sure not to search for your domain name more than once, there are charlatans waiting to snatch your desired domain after a few searches and you’ll end up with nothing. If you find a good one, get it right away. I can vouch for NameSilo as your domain registrar, it’s an excellent domain company unlike GoDaddy and the rest, and their prices are cheaper than everyone else.

Write a Mission Statement

To start a 501c3 nonprofit you need a mission statement. Writing a nonprofit mission statement is very simple, and simplicity is the key here. A nonprofit mission statement shouldn’t be more than 250 characters long or roughly two lines.

The nonprofit mission statement should only cover enough information to convey the purpose of the organization in a manner that is detailed enough to cover its exempt purpose but vague enough to allow it to expand without amending its articles of incorporation. A good mission statement for the purpose of tax exemption status should put the budding nonprofits under the umbrella of the 501 section of the Internal Revenue Code, and should not be too specific.

Example of a good nonprofit mission statement:

- Save the Snails Foundation mission is to save all endangered snail species in urban areas affected by pesticides and loss of habitat due to human factors.

This mission works because it fits the charitable purpose required under 501(c)(3), serves a broad class of beneficiaries (endangered snails), and addresses general conditions (urban habitat loss, pesticides) without getting too specific.

Example of a bad nonprofit mission statement:

- Save the Children Foundation mission is to provide shelter to displaced albino children in the Altagracia region of the Dominican Republic.

This one is too narrow. It limits the organization to a very specific population, with a specific condition, in a single geographic area. Keep your options open, don’t be too specific, you’ll thank me later.

Start a Nonprofit Step 2: Incorporating a Nonprofit Organization DIY, Don’t Pay Anyone

The next step to start and form a 501c3 nonprofit organization which I kept for last but brushed upon earlier is the physical act of incorporating a nonprofit. I have explained in detail on this page and other pages of this website what it entails to incorporate a nonprofit 501c3 organization on a state level. The only thing you should remember from this page before you go to the next is that under no circumstances you should pay any company to incorporate your nonprofit corporation on your behalf, and worst still, in a State other than your resident State.

To start a 501c3 nonprofit you need to obtain a document called the Articles of Incorporation from your State. What you are doing here is incorporating your entity to be effectively recognized as a legal person and hold a corporation status under the laws of your State.

For-profit and nonprofits get some benefits from incorporation such as protection of personal assets of directors and board members in case of bankruptcy, but incorporating a nonprofit is not for receiving benefits, it is mandatory by law and the Department of Revenue to receive your tax exemption status.

- You can NOT apply for tax exemption if you are not a legal entity, hence the need for incorporation. And NO, you can’t just use your LLC. You need to incorporate as a Domestic Nonprofit Corporation. Before you shell out hundreds of dollars to the Company X to start a 501c3 nonprofit organization for you, STOP and read the resources and information on How to Incorporate a Nonprofit Organization Yourself.

Assuming that you’ve already read the How to incorporate a nonprofit DIY, start by going to the office or website of your Secretary of State. They should provide all the information, resources, and forms necessary regarding starting, registering, and forming nonprofits. The process goes like choosing a business name, picking a mission statement, registering the corporation name and mission statement, and filling the incorporation form with your State.

By incorporating your nonprofit using the general form found on your Secretary of State website, you are giving the state minimal information such as your mission statement and the business name to start and form the entity, but the IRS doesn’t care about your State. You need to draft a Complete Articles of Incorporation with specific provisions, and that’s what the IRS accepts. Go here to start drafting your Complete Articles of Incorporation.

Once you apply for incorporation, the Secretary of State will either approve or deny your incorporation request. If you do get approved, you will receive a document called the Certificate of Incorporation, stating that you’re a new legal corporation in your State. You can see a sample of the State Articles of Incorporation here.

Start a Nonprofit Step 3: Assembling the Nonprofit Board of directors

To start a 501c3 nonprofit you need a few other like-minded people who can serve as initial directors of the organization. Selecting the initial nonprofit board of directors or board members is a non-democratic business, but there is no way around it. Each state has a minimum requirement for the nonprofit board size, but as a rule of thumb, nonprofit corporations’ boards should not be less than 3 and not greater than 15. The IRS is not one bit shy about asking you to increase your nonprofit board size, because smaller boards are more prone to corruption.

At the same time, a very large nonprofit board is a nightmare to manage and your board meetings become next to impossible to call. Refrain from electing relatives on your board of directors, keep your family members out of the board business, this is not the Mafia. Nonprofits should not be dynasty-run businesses; elect qualified non-related individuals for your board of directors who care about your mission. Place an ad in the local newspaper or your website, and you’ll attract local talents who share the same passion, have the resources, and will contribute to the success of your nonprofit.

As a rule of thumb, you need the following officer positions:

- President

- Treasurer

- Secretary

- Vice President

Pay attention that these positions are not paid, they cannot be paid for their board duties, or you will lose your tax exemption status. As we go further in the tax exemption application instructions in this website, I cover the nonprofit board and their duties extensively. For the sake of getting the ball rolling, this is the minimum you should know.

I have a complete guide on every aspect of a nonprofit board of directors roles and responsibilities which is a must read for all nonprofit organizations.

Start a Nonprofit Step 4: Preparing the Nonprofit Bylaws

No matter what category your nonprofit organization falls under, whether a church, animal rescue organization, ministry, sports club, art institution, or a humanitarian nonprofit organization; in the eyes of the federal government and IRS, all public charities that qualify for tax exemption status are the same. In order to start a 501c3 nonprofit, the IRS requires new tax exempt organizations to possess certain qualifications and to maintain these qualifications. One of these federal qualifications is to have a strong, structured, and meticulously worded nonprofit bylaws.

A nonprofit bylaws are essentially the rule book that governs day-to-day activities of the nonprofits, and the bylaws are referred to when problems arise and are used to solve the conflicts and problems between board members and employees as well.

Nonprofit bylaws are one of the most important documents that your nonprofit organization requires, so take your time and familiarize yourself with this document.

Not to say that all nonprofit by-laws you’ll find on the internet fall under this category, but be extremely cautious using free documents when it comes to starting a nonprofit 501c3 organization. A monkey can start a 501c3 nonprofit, but staying IRS compliant is a whole different animal.

Over the years I have created and refined the most complete, structured, IRS compliant and proven nonprofit bylaws which has been successfully used by thousands of nonprofits, attorneys, CPAs, and individuals to start a 501c3 nonprofit organization. You can find this nonprofit bylaws template on this page.

Start a Nonprofit Step 5: Preparing the Conflict of Interest Policy

Another very important document that the IRS requires from those who are starting a 501c3 nonprofit organization is the Conflict of Interest Policy. Not only the conflict of interest policy is required by law, it is a vital tool to combat corruption in new 501c3 nonprofits and public charities. In a day and age that nonprofits are increasingly run by mafia-style boards, comprised of paid family members and directors, the need for a solid and functional nonprofit conflict of interest policy is magnified.

In my opinion, and it’s not only mine, it is the IRS’s opinion that a conflict of interest policy is the most important organizational document that your nonprofit can possess and it is fundamental piece in starting a 501c3 nonprofit, maintaining the tax exempt status of the corporation, its reputation, and standing.

Many people have only a vague idea of what conflict of interest actually is or even how to deal with it. I explain in depth in this page what conflict of interest is, how to avoid it, and I have provided an easy to follow template to help draft your nonprofit conflict of interest policy that you can find here.

Start a Nonprofit Step 6: Applying for the Employer Identification Number (EIN)

Step 6 in starting your nonprofit is applying for a Federal Employer Identification Number (EIN). Whether or not your nonprofit will have paid employees, you must apply for an EIN from the IRS. The Employer Identification Number is just like the Social Security Number for organizations and any other type of business, and after receiving this number the IRS will identify your corporation with this number for all tax purposes.

Unlike earlier steps, obtaining an EIN is quick and easy. You apply directly on the IRS website, and within minutes you’ll have your number.

Your EIN must be listed on all supplemental documents for your Form 1023 application – it’s a key requirement for 501(c)(3) tax-exempt status.

It is imperative to know that the Employer Identification Number is not for sale, it has no fees attached to it, is 100% free, and provided by the IRS directly to nonprofits. Do not pay anyone or any company to acquire the EIN for you. Do it yourself, apply for your nonprofit EIN.

Start a Nonprofit Step 7. Filing the application for tax exemption (form 1023)

This step of the forming of a 501c3 organization is omitted from this page as this website in its entirety is dedicated to helping you complete and file the form 1023. You should start with the navigation menu that says Form 1023 Instructions and go down until you finish the application. Every page and every question is explained with examples and references to successful 1023 applications.

Some nonprofit organizations may qualify to use the shorter and faster version of the 501c3 application which is called the Form 1023-EZ. Form 1023-EZ has its downsides and might not be a right choice for your entity so please be sure to read the Form 1023-EZ qualifications and Pros & Cons before deciding on the best course of action.

Starting a Nonprofit in Different States (CA, TX, FL, and NY)

Starting a nonprofit, like starting any business, is a state-level legal proceeding, while applying for tax-exempt status with the IRS is a federal process. When you incorporate a nonprofit organization, you start a legal entity in your state of choosing, but this legal entity is not automatically exempt from taxation just because it has a nonprofit designation.

Let’s look at the four most populous states and their differences when it comes to starting a nonprofit.

How to Start a Nonprofit in California

To start a nonprofit in California, you first file to incorporate as a domestic nonprofit corporation. The State of California has three designations for starting a nonprofit corporation:

- Public benefit corporation

- Mutual benefit corporation

- and religious organizations

Starting a nonprofit as a California Public Benefit Corporation

- If you’re applying for tax exemption on federal level under section 501c3, in most cases your organization should be incorporated as a public benefit corporation in California unless it’s a religious organization such as a church or a ministry.

Starting a nonprofit as a California Religious Corporation

- If you’re applying for tax exemption as a 501c3 church, religious ministry, or other religious services, then your choice is the California religious organization designation.

Starting a nonprofit as a California Mutual Benefit Corporation

- If your nonprofit is benefiting a select and specific group such as cooperative associations, employees unions, business leagues, or other types of organization that do not fall under the 501c3 section of the internal revenue code, then a mutual benefit corporation is the correct designation. However since we’re talking about tax exemption under the section 501c3 here these kinds of corporations are not relevant here.

Starting a nonprofit in California specific requirements

State of California requires you to file and register for charitable solicitation within 30 days of receiving any fund with the California Office of the Attorney General with a very few exceptions such as for religious organization, cemeteries, and other odd types of organization.

- One advantage to starting a nonprofit in California is that the state’s articles of incorporation already include the IRS-required provisions, so you don’t need to add anything extra.

Beside these few differences, the process of starting a nonprofit in California and 501c3 tax exemption process is the same as any other state.

How to Start a Nonprofit in Texas

Starting a nonprofit organization in Texas is by far the easiest and most straightforward process among all states. The Lone Star State is known for its no-nonsense attitude toward businesses, and starting a nonprofit is no different.

- For starters, State of Texas doesn’t have different legal designations for different types of nonprofits. Also, Texas doesn’t require nonprofit corporations to register for charitable solicitation and has one of the lowest incorporation fees.

Once you file for Certificate of Formation with the Texas Secretary of State, whether on paper or online, you’ve officially started your nonprofit as far as Texas is concerned, and that’s it.

The process of applying for 501(c)(3) federal tax-exempt status is the same as in every other state.

How to Start a Nonprofit in Florida

Like Texas, the State of Florida doesn’t have cumbersome laws or regulations for starting a nonprofit. In fact, Florida is even more straightforward when it comes to tax exemption.

- Unlike other states, Florida regards a nonprofit corporation automatically exempt from taxation if it has a 501c3 determination letter from the IRS.

- The only minor downside to starting a nonprofit in Florida is their process for accepting articles of incorporation.

Although Florida has an online incorporation and registration services on SunBiz, the online form does not allow you to file or include the provisions required for IRS tax-exemption. Therefore, when you start a nonprofit in Florida, you should mail your complete articles of incorporation to the Secretary of State.

How to start a Nonprofit in New York

To start a nonprofit organization in New York, you have to file and incorporate as a nonprofit corporation. The process is like every other state that I’ve outlined here with one big difference; the State of New York is very picky with its certificate of incorporation, and you may end up going back and forth with them correcting trivial information on your articles of incorporation.

If you’re starting a nonprofit in New York, file the articles of incorporation the correct way the first time, or you’ll lose all your hair trying to amend and fix it later. Make sure to include the IRS required provisions in the Article Ninth of the NY Certificate of Incorporation from the get-go, or be ready for a cat and mouse game with the New York secretary of state office.

Conclusion

- Do a state business search, select your name, write a mission statement, buy your domain name, and incorporate your corporation in your own state yourself (don’t pay anyone). Have a board meeting and elect your initial board members, adopt the nonprofit bylaws, adopt the conflict of interest policy, and apply for the EIN directly on the IRS’s website.

- Once the preliminary steps of forming a 501c3 are done, start on preparing your form 1023 application using the information and resources on this help site as a guide to walk you through every step of the process of applying for tax exemption under 501c3 section of the Internal Revenue Code.

- If you made it this far down the page – not many do – you seem to be on a mission and have the patience of a saint, so pop open a beer as it’s going to be a long road ahead. Bookmark this site because you’re gonna need it every step of the way, as you may not find it again easily.

Frequently asked questions about starting a 501c3 nonprofit organization

How to Register a 501c3?

You don’t “register” a 501(c)(3). Instead, you apply for tax exemption under section 501(c)(3) of the Internal Revenue Code. There is no such thing as “registering” a 501c3. Achieving 501(c)(3) tax-exempt status is the highest tax privilege the federal government grants to nonprofit organizations. The process to become a 501c3 exempt organization involves submitting an exemption application, which has been detailed earlier in this guide.

Is there a 501c3 registration number?

No, there is no such thing as a 501c3 registration number. The IRS does not issue any special ID number for 501(c)(3) exempt organizations like some states do for nonprofits. Even states that assign nonprofit identification numbers cannot assign a “501c3 number” because 501(c)(3) tax-exempt status is a federal designation unrelated to state registrations.

(Next step) How to Incorporate a Nonprofit Organization

NOTE: If you’d like to receive the following organizing documents:

NOTE: If you’d like to receive the following organizing documents:- Nonprofit Articles of Incorporation,

- Nonprofit Bylaws,

- Nonprofit Conflict of Interest Policy,

- Conflict of Interest Policy Acknowledgment,

- Form 1023 Attachment with all the answers,

- Form 1023 Expedite Letter template,

- and Donor Contribution Form

in Microsoft Word Document format, please consider making a donation and you’ll get to download them immediately. Not only they're worth well over $1000 in value, they will save you weeks of copy pasting and formatting as they are ready to go templates which only need changing names and addresses.